Getting a mortgage with a low credit score can be challenging, but it’s not impossible. Lenders assess risk differently, and some loan programs are more flexible than others. Even if your score isn’t ideal, you may still have options depending on your full financial picture.

Your credit score isn’t just a number: it’s one of the most important factors lenders consider when you apply for a mortgage. Whether your score is excellent, average, or in the low range, the good news is that homeownership is still within reach. Understanding how your credit score affects mortgage approval, interest rates, and loan options can help you plan your next steps.

We’ll break down what credit score you need to qualify for different types of mortgages, what to expect if your score is below 620, and how tools like co-signers or credit improvement strategies can open more doors. Let’s explore how your credit score can work for you, not against you, in today’s housing market.

Quick Summary

You can still get a mortgage with a low credit score, even under 600, with the right loan and guidance

FHA and VA programs offer flexible credit score options.

Key Requirements: FHA loans allow scores as low as 500 with 10% down or 580 with just 3.5% down.

Tip: Pay down credit card balances, fix any report errors, and avoid new credit inquiries to boost your score before applying.

Why Credit Score Matters When Applying for a Mortgage

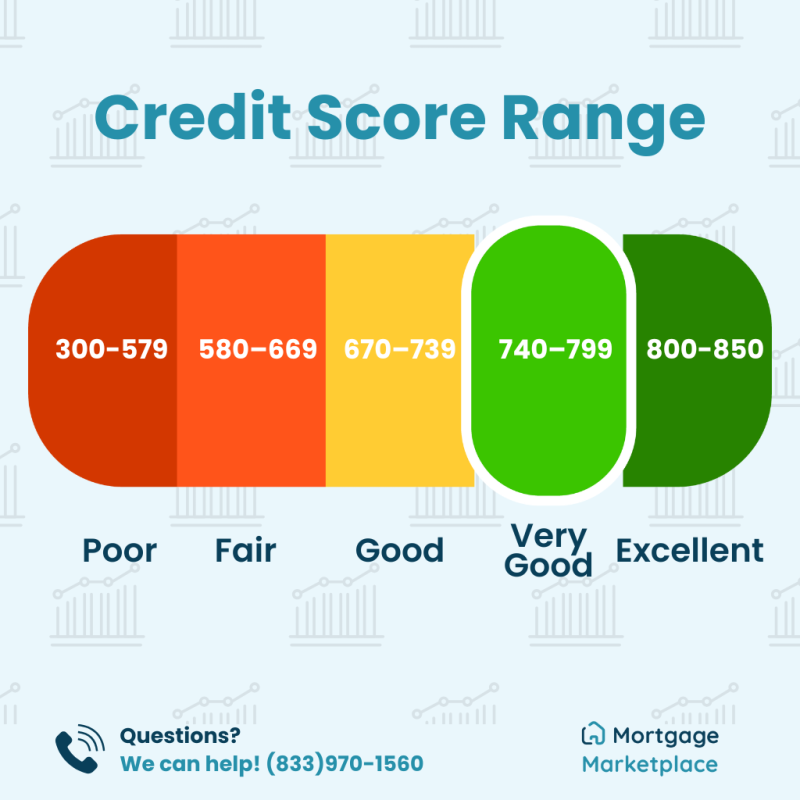

Your credit score is a key factor that lenders use to evaluate your financial health. It helps them assess the risk of lending to you, and a higher credit score usually means better loan terms, lower interest rates, and more loan options. A lower score doesn’t automatically disqualify you, as you may limit your choices or require additional documentation. According to MyFICO, most mortgage lenders look at FICO scores that range from 300 to 850. Scores above 740 are considered excellent, while anything below 620 is typically subprime. Homeownership might feel out of reach if your credit score isn’t perfect; however, there are still plenty of loan options available for many buyers.

Is a FICO Score the Same as a Credit Score?

There are multiple companies that calculate credit scores, but FICO (created by the Fair Isaac Corporation) is the most widely used model, especially in mortgage lending. Other models also generate credit scores, but they may calculate them differently or weigh factors differently. So while a FICO score is a type of credit score, the specific number can vary slightly depending on which scoring model is used and which bureau is reporting it.

Understanding this scoring system gives you more power to make informed financial decisions before applying for a home loan. It also sets expectations early on, helping you avoid surprises and align with lenders likely to approve your application

Want a clearer picture of what you can qualify for? Use our home affordability calculator to estimate your monthly payment and get matched with loan programs that fit your budget.

Minimum Credit Score Requirements by Loan Type

Not all home loans are the same. Each loan program is tailored for different borrower needs and credit score requirements. Let’s take a closer look at the main mortgage loan types.

Conventional Loans

Conventional loans are widely used by homebuyers and are offered through private lenders without government backing. Most traditional lenders require a credit score of at least 620. Borrowers with scores above 740 are more likely to secure lower interest rates and better loan terms. If your score is closer to the minimum, be prepared for a higher down payment or more documentation to support your application.

FHA Loans

FHA loans, backed by the U.S. Department of Housing and Urban Development, are designed to help borrowers with lower credit scores or smaller down payments. With a 580 credit score, you may qualify with as little as 3.5% down. You might qualify if your score is between 500 and 579, but you’ll need a 10% down payment. This flexibility makes FHA loans one of the most accessible options for buyers who need a mortgage with credit score limitations.

VA Loans

VA loans are available to eligible veterans, active-duty service members, and certain National Guard and Reserve members. While the VA does not set a minimum credit score, many lenders prefer a score of at least 580 to 620. These loans offer benefits like zero down payment and no private mortgage insurance (PMI), making them highly attractive to qualified applicants.

USDA Loans

USDA loans are intended for low-to-moderate income borrowers in eligible rural areas. These loans usually require a minimum credit score of 640 to qualify for streamlined processing. However, if your score is slightly below that, you may still be eligible through manual underwriting, which considers additional financial documentation and your overall ability to repay the loan.

Lenders use credit scores to estimate how risky a borrower is. For this reason, a higher score can lead to better rates.

Not sure which loan fits your budget? Run the numbers with our loan comparison calculator and make a confident choice. Call now at (833) 977-1560, Monday through Friday, 9 A.M. – 5 P.M. E.T.

Can You Get a Mortgage with a Low Credit Score?

Mortgage with Credit Score of 0–500

This range presents significant hurdles. Most mainstream lenders won’t approve mortgages in this category. However, it’s not the end of the road. The first step is often credit repair. Reputable organizations like the National Foundation for Credit Counseling (NFCC) can help you build a strategy to raise your score. Once you move above 500, you’ll open the door to some FHA loan opportunities.

Mortgage with Credit Score of 500–579

In this bracket, FHA loans become your primary option, and most lenders will require a 10% down payment. Expect more paperwork and higher interest rates. Lenders will be closely scrutinizing your debt-to-income ratio, employment stability, and any financial red flags on your report. Patience and persistence are key here.

Mortgage with Credit Score of 580–619

You’re in a slightly better position. FHA loans now require only 3.5% down, and some VA or USDA lenders might be open to working with you. Even though you’ll still face higher interest rates than borrowers with higher scores, this range allows for more flexibility and fewer upfront costs. It’s also a good time to shop around — not all lenders assess risk the same way.

Mortgage with Credit Score of 620–699

Many conventional lenders will begin to consider your application in this range. You may not receive the best rates, but you’ll have access to a broader selection of loans and more negotiating power. A strong income, solid employment history, and low debt-to-income ratio can further boost your chances. hurdles.

Additionally, a co-signer might help you qualify if your credit score is too low on its own.

Curious how your credit score affects your rate? Try our mortgage calculator to estimate your payment based on today’s rates and credit tier.

What If You Have a Co-Signer?

A co-signer can be a powerful tool if your credit is holding you back. It adds another person’s credit history and income to your application, giving lenders more confidence in your ability to repay.

How Co-Signers Help Secure a Mortgage

When someone with a strong financial background co-signs your loan, lenders treat your application as less risky. This can increase your chances of approval, help you secure a lower interest rate, or qualify you for a loan you might not get on your own.

Minimum Credit Score with a Co-Signer

While there’s no universal minimum, some lenders may accept a score as low as 500 if your co-signer has excellent credit and a stable income. Keep in mind that the co-signer is equally responsible for the loan. If you default, their credit could take a hit, so it’s crucial to be transparent and have a solid repayment plan in place.

Pros and Cons of Using a Co-Signer

Clear benefits involve better approval odds, access to better loan terms, and an overall smoother process. But there are also risks. The financial burden on your co-signer could strain your relationship, especially if circumstances change unexpectedly. It’s a strategy that requires mutual trust and clear communication.

Don’t wait for perfect credit. Get pre-qualified now and see what’s possible with your current score

What Mortgage Rate Can You Expect Based on Credit Score?

One of the biggest ways your credit score impacts your mortgage is by interest rate. Even a small difference in your rate can add up to thousands of dollars over the life of your loan.

Credit Score and Interest Rate: How They’re Connected

Mortgage lenders use what’s known as risk-based pricing. Essentially, the lower your score, the higher your interest rate, because you’re seen as a greater lending risk. The better your credit score, the less you’ll pay in interest over time.

Rate Estimates by Score Range

Depending on market conditions, borrowers with scores over 800 can often access rates as low as 6.0% or even below. Scores between 740 and 799 are typically eligible for rates around 6.25%, while those in the 700–739 range may see something closer to 6.5%. As your score dips below 700, expect rates to climb. A score in the 620–699 range might come with a rate near or above 7%, and anything below 620 could land you in the 8 %+ range.

What You Can Expect with Excellent Credit

If your credit score is in the 800+ range, you’re in a very strong position. Lenders will offer you their most competitive rates, possibly waive certain fees, and present more favorable loan terms overall. You may also qualify more easily for a wider range of mortgage products.

Mortgage with Credit Score Considerations in Retirement

As you near retirement, your mortgage strategy may look different from what it was during your working years. Fixed income, downsizing goals, or legacy planning can all shape your decisions.

Reverse Mortgages and HELOCs for Retirement

If you’re still carrying a mortgage, refinancing to a lower rate or shorter term may help manage monthly expenses. For homeowners looking to unlock the value of their home, a reverse mortgage could offer access to equity without selling the property, providing added financial flexibility and peace of mind. Depending on your goals, options like downsizing, using home equity lines of credit (HELOCs), or paying off your loan before retirement may also make sense.

DSCR Loans and Second Mortgages for Retirement Goals

If your retirement plan includes a second home, whether as a vacation getaway or an income-producing rental, there are flexible financing tools available. A second mortgage can help fund a new property, while a DSCR (Debt Service Coverage Ratio) loan may allow you to qualify based on expected rental income rather than your personal earnings. These tools can be ideal for retirees exploring short-term rentals or Airbnb-style investments.

Paying Your Mortgage with a Credit Card: Is It Possible?

Wondering if you can pay your mortgage with a credit card? While most mortgage lenders don’t accept credit card payments directly, there are indirect strategies that could make it happen, such as using third-party payment services that charge your card and send a check to your lender.

This approach can offer rewards or short-term cash flow relief, but it often comes with fees and risks like higher interest if balances aren’t paid quickly. If you’re considering this option, it’s essential to weigh the costs carefully and consult with a financial advisor. Ultimately, the best way to prepare is by checking your credit report and exploring the right loan for your financial situation.

Final Thoughts

Your credit score is important, but finding the right lender can make all the difference. A lender who understands your financial situation can guide you through the process with clarity and empathy. It’s not just about finding someone who will approve your loan, it’s about working with a partner who sees your goals, challenges, and potential.

When comparing lenders, look for those who are transparent about fees, flexible with their terms, and experienced in working with borrowers at your credit level. Don’t hesitate to ask questions, request multiple quotes, or seek referrals. A little extra diligence now can lead to a much smoother, more rewarding homebuying experience later.

At Mortgage Marketplace, we make navigating home loans and credit requirements less intimidating. Whether you’re working to improve your score, considering a co-signer, or comparing loan options, we’re here to help you take confident steps toward homeownership.

Get pre-qualified today and start your journey with a lender who understands your financial goals.

I appreciate the breakdown of closing costs—it’s something I hadn’t considered before. Great read!

Sammy P

Queens, NY

5/5

Great article! I didn’t realize how important it is to budget for maintenance and closing costs. Very helpful!

Jeremy M

Georgia, MD

5/5

This was super insightful! The tips on saving for a down payment cleared up a lot of confusion for me.

Tania N

Towns, CA

5/5

FAQ

Can I get a mortgage with a 600 credit score?

+Yes, many FHA and VA lenders accept scores at or above 600, though interest rates may be higher.

Can a co-signer help me qualify for a home loan?

+Absolutely. A co-signer with excellent credit can improve your approval chances and loan terms.

What mortgage rate can I get with a 750 credit score?

+You may qualify for a competitive interest rate around 6.25%, depending on market conditions.

Is 680 a good credit score for a mortgage?

+Yes, 680 is considered a fair-to-good score and should qualify you for several loan types.

What’s the lowest score you can buy a house with?

+FHA loans allow for scores as low as 500 with a 10% down payment. Other lenders may vary.

Why Choose My Mortgage Marketplace?

Simplified Process

Effortless Application, Expert Support

From pre-approval to closing, our streamlined process and experienced team make home financing stress-free.

Tailored Solutions

Personalized Plans for Your Needs

Whether it's refinancing, home equity, or a new mortgage, we customize solutions to fit your financial goals.

Transparent Experience

Clear Rates, No Surprises

We provide competitive rates and full transparency, so you know exactly what to expect at every step.