Securing financing for an investment property generally requires a stronger financial profile than purchasing a primary residence. Lenders typically look for credit scores of at least 700, accompanied by significant cash reserves to cover unexpected expenses or periods of vacancy. These stricter standards are outlined by institutions like Fannie Mae, which sets official guidelines for investment property mortgage qualifications. Debt-to-income ratios are assessed more strictly, ensuring borrowers manage the new property’s financial demands without jeopardizing their financial stability.

Financing an investment property involves different rules, higher standards, and unique opportunities compared to buying a primary residence. Whether exploring your first rental property or expanding your real estate portfolio, finding the right investment property loan is a critical first step. In this guide, we’ll explain how investment property mortgages work, review the financing options available, and walk you through what you need to know to successfully fund your next real estate investment.

Quick Summary

Investment property loans help finance real estate that generates rental income, not used as a primary residence.

Expect higher requirements: larger down payments, strong credit, and full financial documentation.

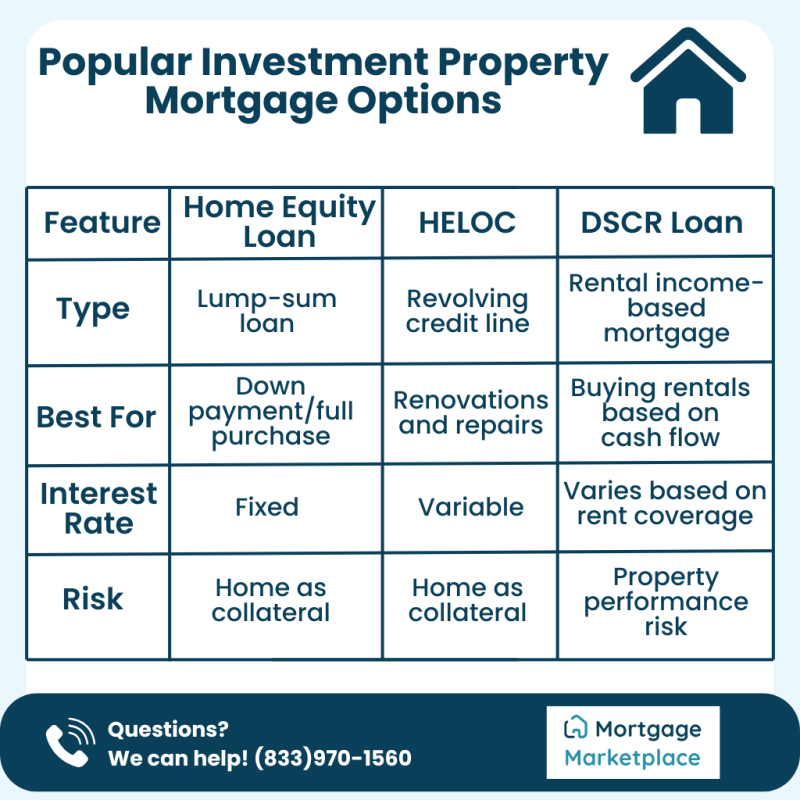

Loan options include conventional loans, HELOCs, home equity loans, and DSCR loans.

Key requirements: 700+ credit score, low DTI, cash reserves, and sometimes projected rental income.

Tip: DSCR loans are great if you want to qualify based on rental income instead of personal earnings.

What Is an Investment Property?

An investment property is real estate purchased for long-term wealth, rather than serving as a primary residence. These properties are typically rented out to tenants, long-term or short-term, or held with the expectation that they will appreciate over time. Unlike a personal home, investment properties are considered income-producing assets, which means they are evaluated differently by lenders and come with their own set of financing rules.

Whether you’re financing a duplex, condo, or short-term rental, use our free mortgage calculators to estimate your payments and see how the property’s cash flow compares.

What Is an Investment Property Loan?

An investment property loan is financing used specifically to purchase real estate intended to generate income. Unlike a primary mortgage to finance a personal residence, investment property loans support ventures that create rental income through long-term tenants or short-term rentals. Because these properties are seen as investments rather than homes, lenders impose stricter terms to account for the added risk associated with rental markets, vacancies, and property management challenges.

How Does It Differ from a Traditional Home Mortgage?

While investment property loans and primary home mortgages involve qualification requirements and risk evaluations, they are fundamentally different. Investment property loans often require larger down payments, carry higher interest rates, and demand more substantial proof of financial stability. Lenders approach these transactions cautiously, understanding that borrowers are more likely to default on investment properties before their primary residences.

Types of Investment Properties Eligible for Financing

Lenders offer financing solutions for property types suited for rental income generation. Single-family homes remain popular, especially for first-time investors seeking easier management. Multi-family properties, including duplexes, triplexes, and fourplexes, offer the advantage of multiple income streams from a single investment. Condominiums and townhomes are also viable, although these may carry unique considerations tied to homeowner association rules.

Short-term rental properties, such as those listed on Airbnb or vacation homes, are increasingly common among investors and may be financed through specialized options like second mortgages, which allow qualification based on the property’s cash flow rather than personal income.

Key Differences Between Investment and Primary Home Financing

Higher Interest Rates and Down Payment Expectations

Investment property loans are often priced higher than primary home mortgages. Lenders factor in the added risks of rental income variability and property maintenance costs, resulting in interest rates that may be 0.5% to 1% higher. Down payment expectations also rise; borrowers should anticipate providing between 15% and 25% upfront. While rates and terms vary based on borrower profiles and lender programs, the premium pricing reflects the protective measures lenders take to mitigate risk.

- Tip: When financing an investment property, plan for at least three to six months of cash reserves, not just what the lender requires. Extra funds can help cover vacancies, unexpected repairs, and market slowdowns, protecting your investment and long-term cash flow.

Ready to take the next step? Get pre-qualified today and explore financing options tailored to your investment goals.

Your Investment Property Loan Options

Conventional loans remain a popular and straightforward financing method for investment properties. These loans offer predictable fixed or adjustable rates but typically demand stricter documentation of income, reserves, and creditworthiness compared to owner-occupied mortgages. Lenders usually require a down payment of at least 15%, with better terms offered to those able to provide 20% or more.

Using a Home Equity Loan to Buy Investment Properties

For homeowners with substantial equity, a home equity loan can be a strategic way to fund the purchase of an investment property. This loan provides a single lump-sum payment, which is often used to cover a down payment or, in some cases, the full purchase price. Home equity loans typically come with fixed interest rates, offering predictable monthly payments over the life of the loan.

However, because your primary residence serves as collateral, this financing method carries personal risk. If the investment property underperforms or remains vacant for extended periods, your home could be affected, a factor worth weighing carefully before proceeding.

Financing Rentals with a HELOC

A home equity line of credit (HELOC) offers a more flexible alternative for investors who want access to capital over time rather than all at once. Unlike a lump-sum loan, a HELOC functions like a revolving credit line, allowing you to borrow, repay, and borrow again as needed. This is especially useful for covering renovation costs, emergency repairs, or ongoing improvements that increase a rental property’s value or appeal. Because HELOCs often come with variable interest rates, they can be less predictable than traditional loans, making careful planning essential to avoid unexpected repayment challenges.

DSCR Loans for Investment Home Financing

Debt Service Coverage Ratio (DSCR) loans are ideal for investors who prefer to qualify based on the property’s income potential rather than their financial metrics. A DSCR loan evaluates whether the property’s rental income can comfortably cover the mortgage payments. This can be particularly useful for borrowers who may not meet traditional income documentation requirements but have a sound investment property with strong rental performance.

Not sure which financing option fits your strategy best? Here’s a quick comparison of some of the most common investment property loan solutions:

How to Qualify for an Investment Property Mortgage

Lenders set a high bar for investment property financing approvals. Credit scores generally must exceed 700, and debt-to-income ratios must remain below 45% to demonstrate responsible management of existing financial obligations. Cash reserves often amount to several months’ worth of mortgage payments, taxes, insurance, and other property expenses.

In many cases, lenders will factor anticipated rental income into the loan application process. Through online tools, borrowers can strengthen their applications by demonstrating that the property will generate sufficient income to support the loan obligations. Before proceeding with any lender, it’s crucial to confirm their licensing status through the NMLS Consumer Access portal, ensuring you are working with a legitimate, accredited professional.

Once you’re financially prepared and meet lender requirements, the next step is moving through the financing process. Here’s a simple overview of what to expect:

Ready to take the next step? Get pre-qualified today and explore financing options tailored to your investment goals.

Current Investment Property Mortgage Rates

Interest rates for investment properties tend to be higher because of the perceived greater risk lenders take when financing non-owner-occupied homes. Investors must cover mortgage payments even when properties may be vacant or under repair, increasing the likelihood of payment default compared to primary residences.

How to Find the Best Mortgage Rates for Rentals

Finding the most competitive investment property mortgage rate requires careful preparation and comparison shopping. Borrowers should review multiple lenders, explore options for paying discount points to reduce long-term costs, and maintain strong credit to qualify for the best terms. In addition, research tools offer valuable insights into current market trends, property listings, and mortgage offerings in various regions that help investors make informed decisions based on location-specific data.

Ready to compare loan options? Use our free mortgage calculators to estimate payments, compare investment scenarios, and find the right financing strategy for your property.

Pros and Cons of Investment Property Loans

Pros

- Passive income potential: Rental payments can generate a consistent monthly cash flow.

- Long-term appreciation: Real estate often increases in value over time, helping build wealth.

- Tax benefits: Owners may deduct mortgage interest, property taxes, depreciation, and operating expenses.

Cons

- Vacancy risks: Gaps between tenants can reduce or eliminate income temporarily.

- Unexpected costs: Repairs, maintenance, and emergencies can cut into profits.

- Market volatility: Changes in the real estate market may affect property values and rental demand.

Create your loan strategy for your property’s cash flow and location with our free mortgage calculators.

Final Thoughts

An investment property loan is more than just a path to real estate ownership, it’s a tool for building long-term wealth, generating passive income, and expanding your financial future. Whether purchasing your first rental or scaling an existing portfolio, the right financing can give you the leverage to invest strategically and confidently.

Of course, investment property loans come with their own set of challenges. Stricter lending requirements, higher interest rates, and market fluctuations all play a role. That’s why it’s essential to understand your options and work with a lender who can guide you through the process.

At Mortgage Marketplace, we make investment property financing approachable. Whether you’re exploring DSCR loans, comparing rates, or weighing the pros and cons of home equity strategies, we’re here to help you make informed, confident decisions.

Get pre-qualified today and take the next step toward building a stronger, smarter real estate portfolio.

I appreciate the breakdown of closing costs—it’s something I hadn’t considered before. Great read!

Sammy P

Queens, NY

5/5

Great article! I didn’t realize how important it is to budget for maintenance and closing costs. Very helpful!

Jeremy M

Georgia, MD

5/5

This was super insightful! The tips on saving for a down payment cleared up a lot of confusion for me.

Tania N

Towns, CA

5/5

FAQ

How do you buy an investment property?

+The process starts with getting pre-approved for financing, researching viable rental markets, and selecting a property that meets your investment goals and budget.

What is the best loan type for investment homes?

+Conventional mortgages and DSCR loans are commonly recommended, but the ideal loan depends on your credit profile, income situation, and the type of property you plan to finance.

Are rental property mortgage rates higher?

+Yes. Rental property loans typically carry higher interest rates than primary home mortgages, reflecting the additional risk lenders assume.

Can you use a DSCR loan to finance a rental?

+Absolutely. DSCR loans are designed to allow investors to qualify based on the property's rental income instead of personal income documentation.

Is buying an investment property still a good idea?

+Real estate remains one of the most reliable long-term investments, particularly for those who conduct thorough research and structure their financing strategically.

Why Choose My Mortgage Marketplace?

Simplified Process

Effortless Application, Expert Support

From pre-approval to closing, our streamlined process and experienced team make home financing stress-free.

Tailored Solutions

Personalized Plans for Your Needs

Whether it's refinancing, home equity, or a new mortgage, we customize solutions to fit your financial goals.

Transparent Experience

Clear Rates, No Surprises

We provide competitive rates and full transparency, so you know exactly what to expect at every step.