Not sure how escrow fits into your mortgage payment? Try our monthly payment calculator to see how taxes and insurance affect your bottom line.

Buying a home involves moving pieces, and one term that often confuses buyers is “escrow.” Whether you’re making an offer on a home, already paying a mortgage, or just wondering what escrow is, escrow plays a crucial role in keeping the process secure, fair, and on track. But what is escrow?

Escrow helps ensure that money and important documents are held safely until everyone involved has met their obligations. It can also be used interchangeably with the term “holding account.” Let’s explore how it works in real estate transactions and monthly mortgage payments, and why it matters for your financial peace of mind.

Quick Summary

Escrow is a neutral account that holds funds or documents during a real estate transaction or mortgage payment process.

Mortgage escrow accounts help manage property taxes and insurance by spreading costs into your monthly mortgage payment.

Key Requirement: Most lenders require an escrow account if your down payment is under 20%.

Tip: Ask about partial escrow waivers. Some lenders offer partial escrow waivers if you meet certain conditions.

Understanding Escrow

According to HUD.gov, escrow accounts help ensure critical payments are made on time, protecting both the borrower and the lender. A neutral third party holds funds or documents for two other parties involved. It ensures that both the buyer and the seller meet the terms of their agreement before money or property changes hands. It plays a behind-the-scenes, but essential role in real estate transactions and ongoing mortgage payments. From holding earnest money to managing ongoing housing costs, escrow provides structure and peace of mind for everyone involved.

The Role of the Neutral Third Party

The holding officer or agent acts as the middleman to protect both sides. They securely manage documents, deposits, and disbursements according to the terms of the contract. This process builds trust and reduces the risk of fraud or miscommunication.

The Escrow Process in Real Estate Transactions

Now that you understand what it means and why it matters, let’s see how the process works when buying a home.

Opening an Escrow Account

Once a buyer and seller agree on terms, an escrow account is opened through a title or escrow company. This account will temporarily hold the buyer’s deposit and other important funds until the closing process is complete. The holding agent or officer also collects necessary documents at this time, such as the purchase agreement, loan instructions, and inspection reports.

Depositing Earnest Money into Escrow

Earnest money is a deposit made by the buyer to show serious intent to purchase. It’s placed in the escrow account and credited toward the final sale. This deposit gives sellers peace of mind that the buyer is committed and provides them a way to back out under valid contingencies, such as failed inspections, without losing their funds.

Managing Contingencies Through Escrow

Contingencies are built-in conditions in the purchase contract that must be satisfied before the deal can close. These often include a home inspection, appraisal, and mortgage approval. The officer ensures that each contingency is met, postpones fund transfers until required actions are taken, and helps coordinate timelines with all involved parties. If any condition fails, the escrow process helps facilitate a cancellation and potential refund of earnest money.

How Mortgage Escrow Accounts Work After Closing

This neutral process appears at multiple stages in your homeownership journey. Here’s how it works both during the home purchase and throughout the life of your mortgage.

After closing, many lenders establish a holding account to manage recurring property expenses. Each month, a portion of your mortgage payment goes into this account to cover your property taxes and homeowners’ insurance. According to the Consumer Financial Protection Bureau, lenders typically require accounts to ensure these critical bills are paid on time, reducing risk for both the borrower and the lender.

Instead of facing large lump-sum bills, you pay gradually, and the lender disburses the payments when due. This simplifies budgeting and ensures your bills are paid on time, protecting you and the lender from lapses in coverage or tax delinquency.

Benefits of an Escrow Account

While escrow might seem like just another layer of paperwork, it’s designed to protect everyone involved. Here are the key benefits that make escrow such a useful tool.

Protection Against Fraud in Real Estate

It protects against fraud by acting as a neutral checkpoint in the transaction. Funds and key documents are only released when all parties meet legal and financial responsibilities. This system prevents one-sided actions and ensures steps are documented and verified. If you’re concerned about wire fraud, forged signatures, or last-minute changes, having a holding account provides an essential safety net.

Safeguarding Both Buyers and Sellers

The holding account allows both parties to be confident in the transaction, knowing neither side can take unfair advantage. Buyers can rest assured that their earnest money is protected, while sellers are guaranteed payment once their obligations are met. This neutral buffer creates a fair playing field and reduces friction throughout the deal.

Enforcing Contractual Obligations

Contracts often include important conditions, such as the seller completing repairs or the buyer securing financing. The officers track these milestones and require proper documentation before releasing funds. If an agreement falls through or terms aren’t met, the process provides legal recourse and prevents premature transfer of assets.

Drawbacks of Escrow Accounts

Although escrow offers plenty of protection, it’s not without its downsides. Let’s explore a few potential drawbacks you should keep in mind.

Higher Monthly Mortgage Payments

Because your holding account includes property taxes and homeowners’ insurance, your monthly mortgage bill may look higher than expected. This doesn’t mean you’re paying more overall, but rather that you’re spreading your tax and insurance costs into manageable monthly portions.

Taxes and insurance rates can change from year to year, and your escrow account may end up with too little or too much money. Some homeowners explore refinancing to secure a better interest rate and potentially lower their overall monthly mortgage payment. Refinancing your home can also affect how your account is handled, potentially resetting or adjusting the balance based on your new loan terms.

Escrow Shortages and Overages

Taxes and insurance rates can change, your holding account may have too little or too much money. Lenders typically conduct an annual analysis to ensure the account is properly funded. If there’s a shortage, you may need to pay the difference or accept a higher monthly payment. If there’s a surplus, you may get a refund or notice a small reduction in your monthly mortgage payment moving forward.

How Escrow Fees and Costs Are Managed

Escrow isn’t free. Here’s what to expect with fees and who typically pays them during the transaction.

Common Escrow Fees at Closing

Escrow services usually come with administrative and transaction-based fees. These can include wire transfer charges, document preparation, notary services, and handling for fund disbursement. Some escrow companies charge fees for managing the account, especially if the process involves multiple disbursements, complex contingencies, or extended timeframes. Review the holding account fee schedule early to avoid surprises at closing.

Who Pays What in Escrow?

Depending on your agreement and local customs, the buyer, seller, or both may share the cost of services. In many markets, buyers cover account-related fees, especially those associated with loan processing. Sellers might be responsible for title-related costs and other closing contributions. Your lender or real estate agent will provide a closing disclosure detailing all the fees and who will take care of each.

Who Manages the Escrow Account?

These specialists handle funds, paperwork, and transaction terms to keep your home purchase on track. These individuals or organizations act as impartial administrators, ensuring the handling of funds, contracts, and required disclosures. Their responsibilities include opening the account, receiving and disbursing funds, confirming contractual milestones, and filing necessary legal documentation. An experienced escrow agent helps prevent delays, ensures compliance with state laws, and keeps all parties on track to meet their obligations.

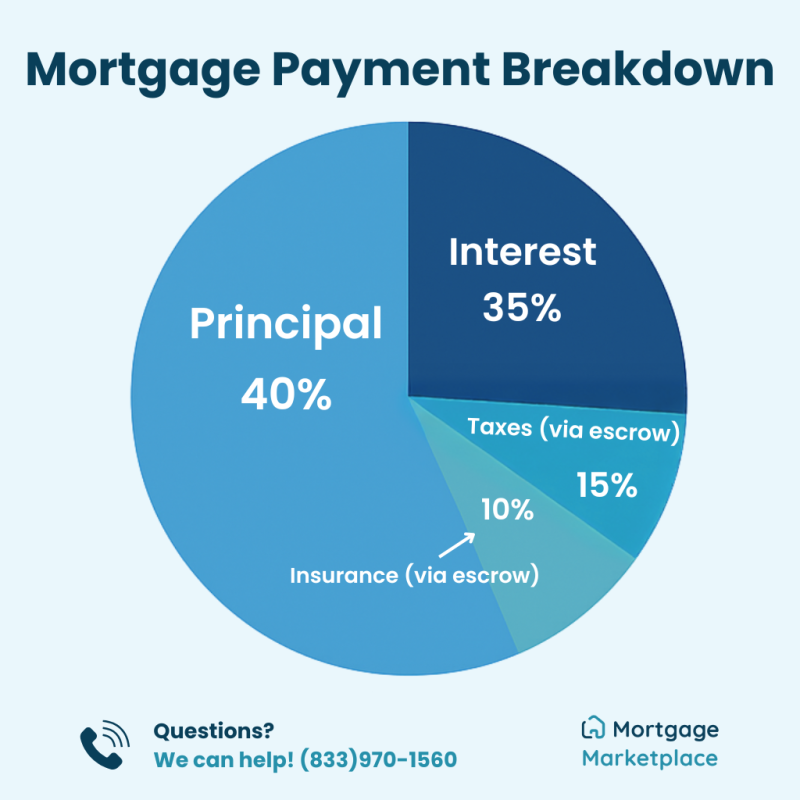

What's in Your Monthly Mortgage Payment?

Your mortgage payment covers more than just your loan. Your mortgage payment covers more than just your loan. Use our mortgage calculator to see how principal, interest, taxes, and insurance break down in your monthly cost.

See the mortgage payment breakdown below:

Think about your credit score and your escrow setup. Learn what lenders require based on your credit profile and see if you qualify to manage taxes and insurance yourself.

Final Thoughts

Understanding escrow is one of the keys to feeling confident as a homebuyer or homeowner. Escrow plays a crucial role in both home buying and homeownership. From holding earnest money to managing ongoing housing costs, this process provides structure and peace of mind.

And as you build equity in your home, you may unlock opportunities to refinance or borrow strategically, giving you more flexibility in managing homeownership expenses like taxes and insurance.

At Mortgage Marketplace, we take the guesswork out of understanding escrow. Whether buying your first home or adding to your investment portfolio, our team helps you navigate taxes, insurance, and monthly payments with clarity and confidence.

Have questions about how escrow works or what to expect at closing? We’re here to make the process smoother, so you can focus on your next move.

I appreciate the breakdown of closing costs—it’s something I hadn’t considered before. Great read!

Sammy P

Queens, NY

5/5

Great article! I didn’t realize how important it is to budget for maintenance and closing costs. Very helpful!

Jeremy M

Georgia, MD

5/5

This was super insightful! The tips on saving for a down payment cleared up a lot of confusion for me.

Tania N

Towns, CA

5/5

FAQ

What is an escrow advance?

+If your escrow account doesn’t have enough funds to cover an upcoming tax or insurance bill, your lender might pay it upfront and allow you to repay it over time.

Do I always need an escrow account?

+Not always. If you make a down payment of 20% or more, some lenders may allow you to waive escrow and pay taxes and insurance on your own.

Is escrow the same as a down payment?

+No. Escrow holds funds for future costs like taxes and insurance. A down payment goes directly toward purchasing the home.

Who holds the money in an escrow account?

+A neutral third party, such as an escrow or title company, holds and manages the funds.

Do I get my escrow money back when I sell my house?

+Yes. Any remaining balance in your escrow account after the mortgage is paid off.

Can you take money out of escrow?

+Generally, no. The funds are designated for specific uses and cannot be accessed freely.

What happens if I back out of escrow?

+You may lose your earnest money deposit, especially if you don’t meet the contingencies outlined in the contract.

Why Choose My Mortgage Marketplace?

Simplified Process

Effortless Application, Expert Support

From pre-approval to closing, our streamlined process and experienced team make home financing stress-free.

Tailored Solutions

Personalized Plans for Your Needs

Whether it's refinancing, home equity, or a new mortgage, we customize solutions to fit your financial goals.

Transparent Experience

Clear Rates, No Surprises

We provide competitive rates and full transparency, so you know exactly what to expect at every step.