Buying your first home can be stressful, requiring mountains of paperwork, boundless patience, a lot of luck, and, often, a sizable payment. Finding your house is difficult enough, but you also need to prepare for the mortgage shopping and application process.

It’s a good idea to seek help with this process, and you are in the right place. Mortgage Marketplace is an expert in the first time home buyer mortgage field, and we’re here with a thorough new house checklist for first time home buyers to help make your first home a winner.

Call us at (833) 970-1560, and we can help make your first time home buying dreams a reality.

Quick Summary

Ensure you’re ready for the commitment ahead of time. Prepare your finances and mental state for the homebuying process.

Preapproval helps you understand the rates you’ll generally qualify for.

Key requirements: You’ll qualify for the best rates if your credit score is at least 620 and your debt-to-income ratio is below 41%.

Tips: Specialty loans like USDA loans, FHA loans, and VA loans can help you qualify for lower rates, but eligibility can be complicated.

New House Checklist: Finding a First Time Home Buyer Mortgage

Finding a mortgage can be the most daunting step in the house shopping process, especially for a first time home buyer. That’s why we’ve placed information about mortgage shopping at the top of our new house checklist.

Types of First Time Home Buyer Mortgage Requirements

The type of mortgage you apply for heavily impacts the interest rates and type of home you can get. The main types of first time home buyer mortgages include:

- Conventional loans

Conventional loans are the most common type of home loan. They aren’t federally backed, so rates, down payment, and eligibility are entirely based on your income, credit score, and wealth history.

- FHA loans

FHA loans are mortgage loans backed by the Federal Housing Administration. Their relaxed credit and income requirements mean they could be a good option as a first-time home buyer mortgage. However, they require mortgage insurance, and the application process can be more complicated.

- VA loans

VA loans are partially backed by the Department of Veterans Affairs, rather than personal income and finances. Only veterans qualify for VA loans. Because the VA backs up to 25% of the loan’s total value, down payments and monthly rates can be significantly lower than a conventional loan.

- Jumbo loans

Jumbo loans are mortgages for homes valued above standard lending limits. Because the loan is larger, they generally mean larger down payments and higher monthly rates.

- Renovation loans

Some lenders offer mortgage loans specifically intended for distressed homes that need repair. A renovation loan could be a great way to save on down payment costs and monthly rates, but eligible properties involve far more work than standard homes.

With so many options, it’s a good idea to find help. Use our mortgage calculator to set a realistic budget for your next home.

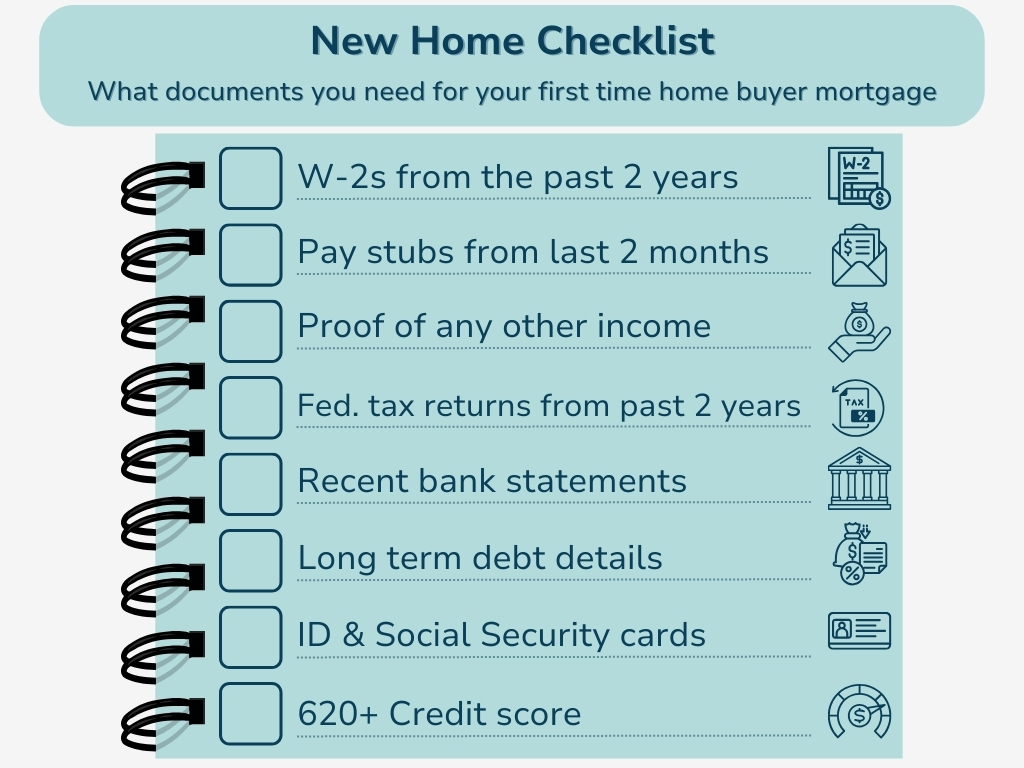

You will need to prepare a lot of paperwork to apply for a mortgage, including:

- W-2 forms from the past two years (you may need more if you have recently changed employers)

- Pay stubs from the past 30 to 60 days

- Proof of any other sources of income, including documentation of any gift money

- Federal income tax returns from the past two years

- Recent bank statements, usually for the past couple of months

- Details on long-term debts, such as car or student loans

- Your personal identification and social security cards

Many lenders have hard credit score requirements for mortgage loans. To qualify for competitive interest rates, you should generally have at least a 620 credit score and a debt-to-income ratio below 41%.

- Tip: This is how lenders determine if they believe you can successfully repay the loan in a timely manner.

First Time Home Buyer Mortgage Preapproval

Getting preapproved for a mortgage can be a good early step in the home buying process. try checking it off early in while working through your own new home checklist. Knowing the rates loan size you qualify for can give you a lot of confidence in the home shopping process.

Lenders submit a hard credit inquiry as part of the preapproval process. This inquiry affects your credit score, so it’s a good idea to pull numbers and preapprovals from multiple lenders at once.

Finding your preferred lender can be overwhelming. That’s where Mortgage Marketplace can help. Contact us now for expert advice to streamline your first-time home buyer mortgage selection process.

- Tip: When you apply for your mortgage, you don’t need to stick with the same lender that may have preapproved your application.

New House Checklist: First Steps

Knowing about your mortgage rates and options is key to entering the home shopping process with confidence. But home shopping can be tough.

You’ll need a lot of patience and quite a bit of luck, too, especially if you live in a seller’s market – one where the number of buyers exceeds the number of sellers, allowing sellers to be picky with offers. In a seller’s market, you may have to make unfortunate concessions. Conversely, if your preferred location is a buyer’s market, one where home supply outpaces demand, you can afford to be the picky one instead.

Competitive markets can be very overwhelming. For a successful house hunt, whether you are a first-time home buyer or a seasoned real estate investor, finding reliable help is key.

Find out how much home you can afford based on your finances with our free home affordability calculator.

Preparing Yourself & Your Finances for Your First Mortgage

When purchasing your first home, you’re committing a large sum of money and a lot of your time, energy, and emotions. Be sure you’re ready for the stress that comes with home shopping and prepare for a lot of failure on the way.

20% of the home’s value is a standard down payment, but you don’t need that much liquid cash ahead of time. You can pay a smaller down payment, but prepare for higher interest rates. A smaller down payment often means you’ll need to pay for mortgage insurance, which will increase your monthly mortgage payment.

- Tip: You should also check if your state has first-time home buyer assistance programs. Some offer financial help and down payment assistance. Visit USA.gov for more information and check your state to see if additional programs are offered.

Mortgage Marketplace can help you find money-saving programs too – contact us today for help.

Create Your Home Wish List

A great first step to the home shopping process is to create a plan for what kind of home you’re seeking. If you’re purchasing your home with a partner, having a list of requirements and less desirable features can save headaches.

Consider the type of property you need. If you’re starting a family or value privacy, a detached single-family home may be preferred. If being close to city or community amenities is a need, a non-detached home like a townhouse may work better.

Everyone’s home wishlist will look different. There’s no one-size-fits-all home type, so it’s up to you to determine what’s important. Remember that more amenities often mean higher costs, so if you are operating on a budget, be careful to stay on course.

Around this time is a good spot to apply for mortgage preapproval. Knowing hard numbers can help you narrow down the type of property you are seeking.

Use our free tools to calculate what fits your budget and move through your homebuying checklist with confidence.

Find A Real Estate Agent

The importance of a good real estate agent cannot be understated. A good agent with your best interests in mind can be a great resource in your house search.

Make sure you shop around for your agent. Ask friends and family for advice and check online reviews. Also, contact agents directly to ensure you connect and that they will respect your needs.

Some real estate agents specialize in helping first time home buyers. Finding a good one would be a great way to start your first house search.

New House Checklist: Getting Your First Home & First Mortgage

Now that you’ve done the groundwork on your new house checklist, it’s time to start searching and prepare to place an offer.

Home Shopping

Home shopping can take a long time, especially if you are moving to a competitive market. If you are moving far from your current home, visit the area, and make sure you actually like where you’re moving and can truly see yourself living there. Consider a different location if you’re having difficulty.

If you like a home, take lots of pictures and videos – it can be easy to forget details or blend features from different homes together. Having floor plans available can help determine how you’ll fit your furniture and life into a new place.

This is a good time to note extra costs, like homeowners association dues, parking spot costs, commute costs, internet and utility rates, and property tax rates. These expenses vary for each home, but they can add up.

- Tip: Lenders also provide a closing disclosure, which tells you how much cash you need for closing costs. Prepare for these costs ahead of time – they often are about one to five percent of the home’s total cost.

Make Your Offer

Once you find your home, it’s time to place an offer.

Remember that offers get outbid all the time. It can be disheartening, but keep your head up, even if you just barely got outbid. If you have space in your budget and like the home, consider a counteroffer, or move on with a better understanding of the types of prices and competition to expect.

If your offer is accepted, congratulations! Hopefully, you have a wonderful new home!

This is likely when you’ll write your first check on your new home too: earnest money, which is an initial deposit made towards the home’s purchase.

- Tip: Earnest money is often placed in an escrow account, and buyers use this as part of their cash to close when the sale goes through.

Once you make your offer, you’ll apply for your mortgage using the steps listed earlier in our new house checklist.

New House Checklist: Final Steps

You’ve selected your house, placed your offer, and applied to your lender – now it’s time for the final steps. Then you can move into your new home.

Secure Homeowners Insurance

Homeowners insurance is important to many lenders since many require it as a condition of getting a mortgage. Just make sure you have enough coverage to fully replace the home in case of disaster. Note the rate – you’ll be paying that monthly alongside your mortgage.

Home Inspection

The home inspection is generally the last chance to back out of a home purchase, so ensure you hire an inspector who will do a thorough job. If home issues were obscured or previously unidentified, an inspector can unearth them.

If you’re especially worried about carbon monoxide, radon, and other harmful chemicals, the home inspector can test for those too.

After all, you’re paying for the inspection. Just like when you shopped around for realtors, check reviews and ask for recommendations for inspectors. The right one can help you proceed with your home purchase with confidence. You’ll also get an idea of repairs and appliance replacements that may come up soon.

Home Appraisal

Many lenders require a home appraisal as a condition of the mortgage offer to ensure they aren’t lending you too much money. This is another up-front cost you’re expected to cover – the lender selects the appraiser, but you’ll have to pay for their services.

Your home’s value plays a big role in how much equity you can access. Use our home equity calculator to estimate your borrowing power based on your latest appraisal.

Negotiate Any Repairs Or Credits

This is your last chance to make any necessary tweaks to your offer. If the inspection unearthed any hidden issues, you can negotiate to have those repaired.

- Tip: Most sellers are motivated to finish the selling process quickly, so it may be best to ask the sellers for credit. For example, if the refrigerator needs to be replaced and will cost $1,500, ask the sellers for a $1,500 reduction in the home’s price.

Each seller is different, so approach these last-minute negotiations with care. This also depends on your market. Unfortunately, you may not have room to make demands in a seller’s market.

“Home loan” and “mortgage” are used interchangeably, and while they are similar, they have slightly different meanings. A mortgage is a loan used to buy a residence and the home is the collateral for the loan. A home loan is a type of mortgage that is used to buy a home.

Make Your Offer

The final step in your first time home buying process is the close. Most closing processes involve a standardized set of documents that you can familiarize yourself with ahead of time.

You’ll also have a final walkthrough with your real estate agent to ensure the home is still in good shape and left as agreed upon.

Once the closing documents are signed, you’ve completed our new house checklist – and have a new home!

Final Thoughts

From selecting your home to applying for your first time home buyer mortgage, buying a home can be a tiring process. This is why you should find good support, from a helpful, knowledgeable real estate agent to a lender who can get you the best rates available.

Mortgage Marketplace is here to help you with every step of the process. Contact us today, and we can help you with your first time home buying journey.

I appreciate the breakdown of closing costs—it’s something I hadn’t considered before. Great read!

Sammy P

Queens, NY

5/5

Great article! I didn’t realize how important it is to budget for maintenance and closing costs. Very helpful!

Jeremy M

Georgia, MD

5/5

This was super insightful! The tips on saving for a down payment cleared up a lot of confusion for me.

Tania N

Towns, CA

5/5

FAQ

What are the requirements for a first time home buyer mortgage?

+Most conventional mortgages require a credit score of 620 or higher, but you’ll often qualify for the best interest rates with a score above 760. It’s also best to have a debt to income ratio below 41% too. Non-conventional mortgage loans like FHA loans, VA loans, and others have different requirements.

What are the general steps on a new home checklist?

+The home buying process is fairly complicated, but general steps you need to keep in mind for your buying a new home checklist include:

- Preparation

- Selecting your mortgage type

- Creating a wishlist

- Getting preapproved for your first time home buyer mortgage

- Finding a real estate agent

- Home shopping

- Getting your first time home buyer mortgage

- Closing

What kind of home works best for a first time home buyer?

+The best first home buyer property comes down to personal preference. If you are starting a family or prefer space, a detached single-family home may work best. If you value being near a city or local amenities, a townhome or other non-detached property may work better.

Why Choose My Mortgage Marketplace?

Simplified Process

Effortless Application, Expert Support

From pre-approval to closing, our streamlined process and experienced team make home financing stress-free.

Tailored Solutions

Personalized Plans for Your Needs

Whether it's refinancing, home equity, or a new mortgage, we customize solutions to fit your financial goals.

Transparent Experience

Clear Rates, No Surprises

We provide competitive rates and full transparency, so you know exactly what to expect at every step.