Unsure which loan works best for your budget? Use our loan comparison calculator to crunch the numbers and choose with confidence. Have questions? Give us a call at (833) 977‑1560, Monday–Friday, 9 a.m. to 5 p.m. ET.

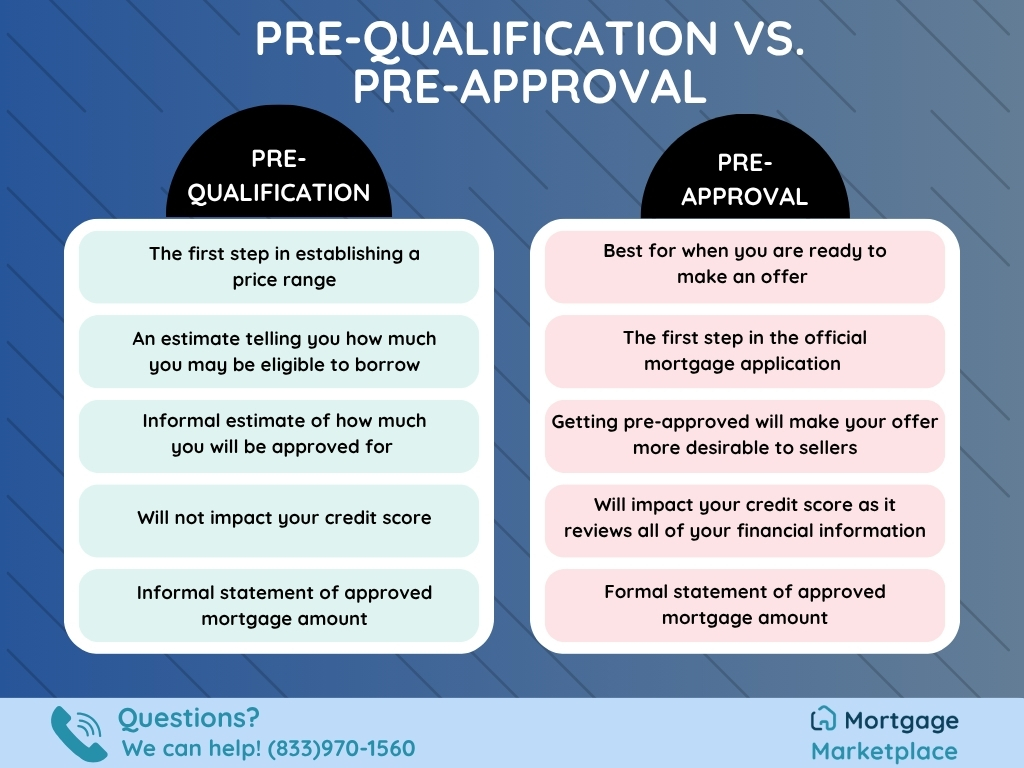

Purchasing your first home can be confusing, especially when there are many confusing terms, such as “pre-approval” and “pre-qualification.” They seem similar enough, but they mean completely different things when it comes to mortgages. Knowing the difference between the two can mean the difference between getting a loan and not. Essentially, they are two different levels of mortgage eligibility.

Purchasing your first home can be stressful, but Mortgage Marketplace is here to make the process easier. Call us at (833) 970-1560, and we can help make your dream home a reality.

Quick Summary

Mortgage pre-qualification refers to an early and less formal phase of applying for a mortgage based on information you provide.

Mortgage pre-approval will help you understand the rates you will qualify for, and it will help your real estate agent find a home in your price range.

Key requirements: You’ll need to submit income, ID, and financial documents.

Tips: The pre-approval process may slightly affect your credit score, but often minimally or not at all.

Mortgage Pre-approval vs. Pre-qualification

Mortgage pre-qualification is an initial step that provides a rough estimate of how much you can borrow for a home loan. It is based on the credit, asset, and income information you provide to the lender. The lender usually does not verify a credit score during pre-qualification, but some will conduct a soft credit check. Some lenders will provide a pre-qualification letter that you can present to real estate agents as proof of your financial standing.

Mortgage pre-approval is more formal than pre-qualification and involves a detailed review of your financial history. Your lender will verify your aforementioned income, debt, and assets and pull your credit report. Upon approval, you will receive a pre-approval letter from the lender that lists the maximum amount you are eligible for. A pre-approval letter is extremely helpful when making an offer on a home, as it will demonstrate to sellers that you are a serious buyer and have the means to complete the purchase.

Mortgage Pre-approval vs. Pre-qualification Key Differences

Impact on Home Buying:

Pre-qualification provides a general estimate of the loan amount, while pre-approval gives a more accurate loan amount that can be used to negotiate with sellers. If you are pre-approved and can share the specific number with sellers, they may be more likely to accept your offer.

Formality and Documentation:

Pre-qualification can be completed with minimal documentation and is a fairly quick process. In contrast, pre-approval requires a formal application that includes financial documents.

Credit Check:

Pre-qualification is a more casual process and may not require a hard credit inquiry, whereas pre-approval usually involves a hard inquiry on your credit report, which can temporarily impact your credit score.

Now that we’ve defined what makes suburban living appealing, let’s look at where first-time buyers are moving, and why.

Next, we will review what information will be provided to you in a pre-approval letter.

What Information Is In A Mortgage Pre-Approval Letter?

A mortgage pre-approval letter will usually include the following: lender’s name, borrower’s name, maximum loan amount, interest rate, loan term, and expiration date.

Pre-approval letters usually include an expiration date between 60 and 90 days. If you haven’t found a home during that time frame, you must submit for a renewal to ensure your pre-approval is still valid. Getting pre-approved will not impact your credit score like a pre-approval would. A pre-qualification is a more informal assessment and is often used for informational purposes, but it is not verified at this stage in the process.

Benefits of Mortgage Pre-Approval

A mortgage pre-approval can give you an advantage when purchasing a home. A pre-approval demonstrates your financial readiness and commitment, which strengthens your offer. A seller is more likely to accept an offer from a pre-approved buyer, as this will expedite the closing process. You will also have more negotiating power once you have been pre-approved, as the seller will feel more comfortable making an agreement with someone who has been pre-approved. It is important to note that pre-approvals will eventually expire after a certain amount of time, so it is best to keep this in mind during the home-buying process.

Mortgage Pre-Approval Requirements

To obtain a mortgage pre-approval, you will typically need to provide the following documentation:

- Proof of income: This can include a recent pay stub, W-2 form, or a tax return if you are self-employed

- Asset documentation: Documentation of your checking, savings, and other investment accounts

- Employment verification: Pay stubs from your place of employment will assist in verifying your employment status and income. Self-employed individuals may need to provide additional documentation such as tax returns,

- Identification: A government-issued ID, such as a driver’s license or passport, will suffice as proof

- Social security number: This will be used to verify your identity and to view your credit report

This information will allow your lender to view your financial situation and determine whether or not you are eligible for a mortgage loan.

When To Get Pre-Approved For A Mortgage?

Pre-approval isn’t just for your lender; it can also let you know what you can afford when you begin looking at homes. The best time to get pre-approved is at the beginning of your home-buying journey. This is important for first-time buyers to keep in mind before they begin looking at homes. Knowing your price range will allow you to look at homes in your price range and let you know how much mortgage you can expect to take out.

Get Your Credit Score Checked

Pre-approval typically requires an extensive inquiry into your credit. This may temporarily cause your credit score to drop slightly. Following inquiries from other mortgage lenders within 30 days will not impact your score.

If you are applying for mortgage pre-approval with various lenders within a short time frame to find the best rates, you do not need to worry about your score dropping each time a lender checks your credit. Credit bureaus understand that you are likely comparing mortgage rates for one loan, and they will offer a grace period where multiple credit inquiries will count as one. Make sure to apply for your pre-approvals within a similar time frame so that the inquiries will be counted as a single inquiry.

Receive Your Mortgage Pre-approval Letter

When you are pre-approved, you will typically receive a pre-approval letter. A pre-approval letter is a statement from a lender stating that they are tentatively willing to lend you money. This letter is important for a variety of reasons:

- Sellers often want to see a pre-approval letter before accepting your offer on their home because it lets them know you are likely to get financing.

- A pre-approval letter allows a real estate agent to understand your price range and will prevent them from showing homes that are out of your price range.

- The pre-approval letter serves as a formal commitment from a lender to lend you a certain amount of money to purchase a home.

- Pre-approval will make your offer more enticing to the seller

Home Mortgage Loans

Coventional Loans

Conventional loans are the most widely used type of mortgage. Since they aren’t insured by the federal government, factors like your income, credit score, and financial history determine your interest rate, down payment, and overall eligibility.

FHA Loans

FHA loans are a common choice for first-time homebuyers thanks to their more lenient credit and income criteria. However, they typically involve higher mortgage insurance premiums and more stringent appraisal standards.

VA Loans

VA loans, supported by the Department of Veterans Affairs, provide valuable advantages such as zero down payment and competitive interest rates, but they’re exclusively available to eligible U.S. military veterans. For buyers who don’t qualify for VA benefits and are seeking an alternative to FHA loans with potentially lower long-term expenses, USDA loans can be a great option—particularly for those buying in rural or suburban communities.

Mortgage Pre-Approval Final Thoughts

A mortgage pre-approval is an indispensable first step in the home-buying journey, offering a clear understanding of your borrowing power and signaling your seriousness to sellers. By securing your pre-approval, you gain a significant advantage in a competitive market and streamline the home-buying process, making it more efficient and less stressful. Additionally, it empowers you to shop for homes with confidence, knowing you’re looking at properties within your financial reach, and in the end, paves the way for a smooth and successful home purchase.

Have questions about getting pre-approved? Call now at (833) 977-1560, Monday through Friday, 9 a.m. to 5 p.m. ET. and connect with an expert at Mortgage Marketplace for guidance tailored to first-time buyers. We’ll help you explore options, understand the difference between pre-approval and pre-qualification, and navigate today’s housing market.

I appreciate the breakdown of closing costs—it’s something I hadn’t considered before. Great read!

Sammy P

Queens, NY

5/5

Great article! I didn’t realize how important it is to budget for maintenance and closing costs. Very helpful!

Jeremy M

Georgia, MD

5/5

This was super insightful! The tips on saving for a down payment cleared up a lot of confusion for me.

Tania N

Towns, CA

5/5

FAQ

Why Should I Get A Mortgage Pre-Approval?

+TMortgage pre-approval is beneficial for home buyers for various reasons. It helps buyers search for homes within their budget, which makes for a smoother and more efficient house hunt. It also makes an offer more enticing to a seller, and gets a bulk of the mortgage process completed early.

How Long Does Mortgage Pre-Approval Last?

+If you’re preapproved, you’ll receive an approval letter offer that lasts for 60-90 days, depending on the lender. After that, you’ll need to apply again with another credit pull and updated paperwork.

What Factors Are Considered For Mortgage Pre-Approval?

+In addition to considering your credit score, lenders will want to verify your employment and income. They will also consider your debt-to-income ratio. This is a calculation of your total monthly debts divided by your monthly income. This ratio, expressed as a percentage, helps lenders make sure you have enough income to reasonably cover debts.