Jumbo loans are designed for homebuyers purchasing properties that exceed conforming loan limits. In 2025, those limits start at $766,551 for most single-family homes, and even more in high-cost areas. We break down everything you need to know so you don’t have to: how jumbo loans work, current rate trends, who qualifies, and how they compare to other loan options.

Quick Summary

Jumbo loans finance homes that exceed conforming loan limits, making them ideal for high-cost markets and luxury properties.

Strong finances required, including good credit, low DTI, and large down payment.

Key requirement: Most lenders want a 700+ credit score, though strong compensating factors can help.

Tip: Be ready with full documentation: W-2s, tax returns, and asset statements to avoid delays.

What Are Jumbo Loans?

Jumbo loans are mortgages that exceed the borrowing limits set by government-backed agencies.

Understanding Jumbo Loans

These loans fall into the non-conforming category because they exceed the limits set by government-sponsored enterprises like Fannie Mae and Freddie Mac, and therefore can’t be purchased or guaranteed by them. They’re most commonly used to finance luxury homes or properties in high-cost housing markets, and they usually come with stricter qualification requirements.

How Do Jumbo Loans Work

Navigating the world of home financing can feel overwhelming, especially when you’re considering properties that fall outside the bounds of traditional mortgage limits. Jumbo loans serve as a solution for buyers in high-cost markets who need access to larger amounts of financing. Whether you’re upgrading your home or purchasing an investment property, understanding how jumbo loans work can help you move forward with confidence.

If you’re still early in the homebuying journey, our new house checklist can help you stay organized and prepared.

Jumbo Loan Amounts and Qualification Thresholds

Jumbo loans don’t have a set maximum loan amount. Depending on your finances and lender, you may be able to borrow $1 million or more, but that also means stricter requirements. However, these larger loan sizes come with stricter qualification standards to protect lenders from risk.

How Much Can You Borrow With a Jumbo Loan?

There’s no official ceiling, but jumbo loans can range anywhere from $800,000 to $2 million+, depending on your lender, location, and financial profile.

In 2025, the conforming loan limit is:

$766,551 for most areas

Over $1 million in high-cost regions like parts of California, New York, and Washington D.C.

If your mortgage exceeds these amounts, you’ll need a jumbo loan.

- Tip: Even if you qualify, it’s worth comparing multiple lenders to get the best rate and terms on your jumbo loan. Not all lenders have the same requirements

Ready to take the next step? Get pre-qualified today and explore financing options tailored to your investment goals.

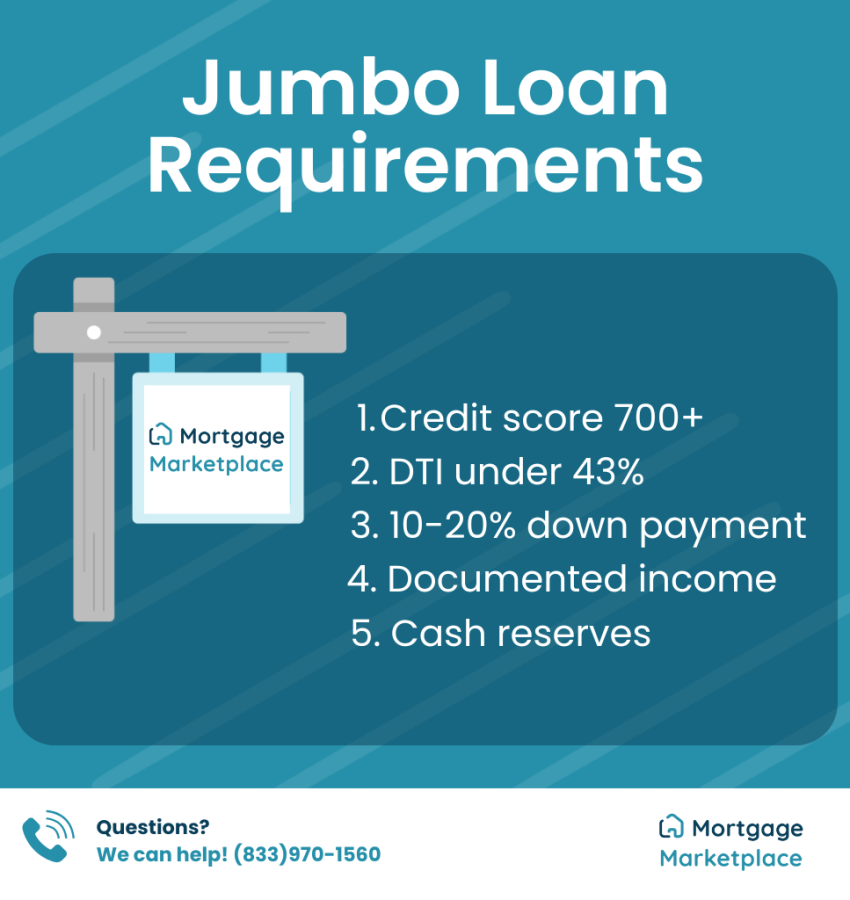

How to Qualify for a Jumbo Loan

Because jumbo loans involve larger amounts, lenders enforce more rigorous qualification standards. By organizing your financial documents early and understanding the key requirements, you position yourself to qualify for a jumbo loan.

Credit Score Requirements

Most lenders require a credit score of 700 or higher. Some may consider scores as low as 680 if you show strong compensating factors, such as a low LTV.

Down Payment Expectations with Jumbo Loans

Depending on your lender and loan size, expect to contribute 10% to 20% down.

For example:

- A 20% down payment on a $900,000 home totals $180,000

- Some lenders accept 10% down with PMI or a second lien

- You can use gift funds, but you must document them thoroughly

Income & Debt-to-Income Ratios

Aim to keep your DTI ratio below 43%, although many lenders prefer 36% or less for better loan terms. Your credit history also plays a major role in loan approval, and understanding how lenders assess your credit can help you better prepare for the process. Document your income clearly with W-2s, tax returns, and recent bank statements.

Closing Costs to Expect

When closing with jumbo loans, closing costs are often higher than conventional loans, typically ranging from 2% to 5% of the loan amount.

Be prepared for:

- Additional appraisals, especially for luxury properties

- Higher title insurance premiums based on the property value

- Escrow reserves for taxes and insurance, which can significantly increase upfront costs

Depending on your lender and loan size, expect to contribute 10% to 20% down.

Alternatives to Jumbo Loans

Conventional Loans

If you’re purchasing a home that falls within the conforming loan limits, a conventional mortgage may be your best option. These loans are not backed by the government, but they’re typically easier to qualify for than jumbo loans and may come with lower interest rates and less stringent requirements.

FHA Loans

FHA loans, insured by the Federal Housing Administration, are especially helpful for borrowers who may not meet jumbo loan standards, offering lower down payment requirements and more flexible credit guidelines.

USDA Loans

For buyers in rural or suburban areas, USDA loans could also be a strong option. They typically offer no down payment and come with competitive interest rates, making them ideal for qualifying borrowers outside metro markets.

Not sure if conventional, FHA, or USDA loans are right for you? If you’re a veteran or active-duty service member, be sure to explore VA jumbo loans. Learn more in the next section below.

VA Jumbo Loans: What Veterans Need to Know

If you’re a qualifying veteran, service member, or surviving spouse, you may have access to a VA loan. This can be a powerful benefit that allows you to finance high-value homes with more flexibility, with no maximum loan limit.

Who Qualifies for a VA Jumbo Loan

Requirements vary by lender. Your borrowing power depends on lender-specific guidelines and your eligibility. Many VA lenders offer jumbo loans above the conforming limits, with no down payment required in some cases. but typically:

- No down payment is required for loans up to $1.5 million with a minimum FICO® Score of 640

- Borrowers with a 680+ score may qualify for loans up to $2.5 million

- You’ll need sufficient residual income and a low debt-to-income ratio, similar to standard VA loan expectations

Property and Appraisal Standards

The VA applies the same livability standards to jumbo loans as conventional VA loans. The property must be safe, sound, and sanitary. That means even high-priced homes still need to pass the VA’s appraisal guidelines, which are often more thorough than those for conventional loans.

VA Funding Fee

The VA funding fee on jumbo loans is higher due to the loan size, typically ranging from 1.25% to 3.3%. You can finance this fee into the loan or, in some cases, ask the seller to cover it through concessions. Like standard VA loans, VA jumbo loans are limited to primary residences. Vacation homes and investment properties aren’t eligible.

If you’re not ready for a jumbo loan or only need to borrow against existing equity, a HELOC might be a more flexible financing option

- Tip: If you qualify for a VA loan and shop in a high-cost market, a VA jumbo could offer lower upfront costs than a conventional jumbo, especially if you want to avoid a large down payment.

Pros and Cons of Jumbo Loans

Every mortgage product comes with advantages and trade-offs, and jumbo loans are no exception. Understanding both the benefits and the challenges of these high-value loans can help you decide if they’re the right fit for your situation.

Pros

- Allows access to homes in competitive, high-cost markets

- Offers potentially lower rates for qualified buyers

- Includes flexible structures like interest-only or ARMs

Cons

- Requires stricter qualifications

- Carries higher closing costs and reserve requirements

- Often demands additional appraisals or extensive documentation

If you’re already in a jumbo loan and wondering what your options are for lowering costs or accessing home equity, refinancing could be the next strategic step.

Can I Refinance a Jumbo Loan?

Refinancing your jumbo loan could reduce your monthly payments, lower your rate, or unlock cash from home equity. Many borrowers consider refinancing when they experience changes in income or want to leverage built-up equity, and understand the available options.

To refinance successfully, borrowers should:

- Maintain strong credit

- Present a low DTI

- Show adequate home equity

Refinancing a Jumbo Loan

Most lenders require a new appraisal when refinancing a jumbo loan. Some lenders may offer streamlined jumbo refinance programs to simplify the process. Generally, refinancing is most beneficial when market interest rates are lower than your current rate or if your income has increased, making you eligible for better loan terms.

Use our Mortgage Calculator to compare refinance scenarios and monthly payments.

- Tip: Shop multiple lenders. Jumbo loan guidelines vary by institution, so comparing offers can help you find the best rate and most flexible terms for your situation. Some lenders specialize in high-net-worth borrowers and may offer better deals or streamlined approval.

Final Thoughts

Jumbo loans give buyers in high-cost markets access to the financing they need. When you understand the qualifications, rate advantages, and potential drawbacks, you can make an informed decision.

Still have questions? The team at Mortgage Marketplace is here to help. Start your application today and discover how jumbo financing can bring your next home within reach.

I appreciate the breakdown of closing costs—it’s something I hadn’t considered before. Great read!

Sammy P

Queens, NY

5/5

Great article! I didn’t realize how important it is to budget for maintenance and closing costs. Very helpful!

Jeremy M

Georgia, MD

5/5

This was super insightful! The tips on saving for a down payment cleared up a lot of confusion for me.

Tania N

Towns, CA

5/5

FAQ

Are jumbo loans assumable?

+Most jumbo loans are not assumable, meaning a new buyer typically can’t take over your rate and terms. However, some non-QM lenders may offer assumable jumbo options on a case-by-case basis, especially in high-value markets.

Are jumbo loans non-QM?

+Some are, but not all. A non-QM (non-qualified mortgage) doesn’t follow the strict underwriting rules of QM loans, which can make them more flexible. Many jumbo loans are non-QM because they exceed conforming loan limits or have unique borrower profiles.

Why are jumbo loans cheaper right now?

+Surprisingly, jumbo loans can have lower rates than conforming loans. This is often because borrowers are highly qualified, and lenders see less risk. Also, private banks and lenders sometimes offer better rates to attract high-net-worth clients.

Are jumbo loans non-conforming?

+Yes. By definition, jumbo loans are non-conforming because they exceed the loan limits set by Fannie Mae and Freddie Mac. That means they can't be sold to those agencies and must be held by lenders or sold through private channels.

Where do jumbo loans start?

+In most areas, jumbo loans start at $766,551 for single-family homes in 2025. In high-cost housing markets, the threshold is higher, sometimes over $1 million. Always check your county’s limit to know where jumbo begins.

Why Choose My Mortgage Marketplace?

Simplified Process

Effortless Application, Expert Support

From pre-approval to closing, our streamlined process and experienced team make home financing stress-free.

Tailored Solutions

Personalized Plans for Your Needs

Whether it's refinancing, home equity, or a new mortgage, we customize solutions to fit your financial goals.

Transparent Experience

Clear Rates, No Surprises

We provide competitive rates and full transparency, so you know exactly what to expect at every step.