If you’re one of the millions of Americans carrying debt and own at least part of your home, utilizing a home equity loan for debt consolidation may be a solution to your debt. Home equity loans draw from the owned value in your home, paying a single lump-sum loan that can be used for anything you need.

Debt from credit cards, personal loans, medical bills, and more troubles millions of Americans. Taking stock of your debt, addressing compounding bills, and consolidating them are great steps toward financial health.

Mortgage Marketplace can help you determine if a home equity loan for debt consolidation is a good step for your financial future. Call us at 1 (833) 970-1560, and we can help you start your process toward financial recovery and home financing.

Quick Summary

Your home serves as security for home equity loans, so they offer lower interest rates than credit cards and personal loans.

Because your home is the loan’s security, failure to pay the loan can result in home foreclosure.

Key requirements: You generally need to own at least 20% of your home’s equity to qualify for a home equity loan.

Tips: Home equity loans are a great way to consolidate debts, but check rates for multiple debt consolidation methods to ensure you maximize savings.

Using a Home Equity Loan for Debt Consolidation

The biggest reason why a home equity loan for debt consolidation can be a good idea for so many homeowners is the interest savings it can offer. Home equity loan rates are typically significantly lower than credit cards and other unsecured loans. This is because home equity loans use your home as collateral, while unsecured loans have no collateral basis.

Interest rates for credit cards and other unsecured debt often range from 20 to 30 percent annually, while home equity loan rates are typically around 10 percent. Another advantage to home equity loans for debt consolidation is that their rates are fixed, while rates for unsecured debt can often vary.

Having a single bill from a home equity loan for debt consolidation can make keeping track of your finances significantly easier. After all, having one fixed monthly payment can be significantly easier to remember than multiple due dates for different debt sources with varying payment amounts.

Estimate the available equity in your home for your borrowing needs with our free home equity calculator.

Types of Debt You Should Consolidate with a Home Equity Loan

Home equity loans are best used to build wealth by consolidating high-interest debt. Some debt types well-suited to debt consolidation with a home equity loan include:

- Credit card debt

Credit cards are one of the biggest sources of debt plaguing Americans. Credit card interest rates are often over 20 percent, meaning you can save a significant amount of money by covering that debt with a loan with a lower interest rate. - Unsecured personal loans

Rates for unsecured personal loans can skyrocket like credit cards, so you could save by switching to secured debt. - Medical bills

Millions of Americans struggle with medical bills, and a home equity loan could help. However, if medical debt is your primary source of debt, check with your healthcare provider first. Low-interest medical payment plans could help cover medical debt, and your provider may even forgive the debt.

Types of Debt to Avoid Consolidating with Home Equity Loans

Home equity loans are good for covering high-interest debts. However, they’re best used to build wealth, rather than making general-use purchases. Below are types of debt and expenditures that you should avoid consolidating with a home equity loan:

- Auto loans

Automobile loans typically offer competitive rates, so you may not save a lot by switching that debt to a home equity loan. In addition, cars depreciate in value, meaning you won’t be building a lot of wealth by using a home equity loan to consolidate automotive debt. - Vacations and luxury items

While it may be tempting to use funds from a home equity loan for a vacation or a luxury purchase, they won’t help your financial health. Everyone needs an occasional break or something nice, but home equity isn’t the best source to cover such expenditures. - Mortgages

Covering a mortgage debt with a home equity loan isn’t the best idea, primarily because home equity loans often have a higher interest rate than primary mortgages. If your mortgage rate is unsustainably high, consider refinancing rather than taking a second mortgage against your property.

Home Equity Debt Consolidation Loan Requirements

Applying for a home equity loan for debt consolidation usually has lender requirements. Each lender’s requirements are different, but it’s best that you own at least 20% of your home’s value in equity and have a credit score of at least 620.

Lender requirements are often negotiable, but may involve taking a smaller loan, raising interest rates, or raising credit score requirements. Contact your lender or Mortgage Marketplace to learn more and take the guesswork out of home equity loans.

Pros & Cons of Using a Home Equity Loan for Debt Consolidation

Home equity loans can be a great way to cover debt, but this debt consolidation method has some drawbacks to consider. Here are just a few of the pros and cons of debt consolidation you should know about:

Pros

- Lower interest rate

Your home is a valuable form of collateral for the loan, so interest rates are much lower than those of unsecured debt like credit cards and personal loans. - Flexible credit score requirements

While it’s best to have a credit score of at least 620 to qualify for the best home equity loan rates, requirements can be flexible. This is especially true if you’re willing to negotiate your interest rate or loan amount. - Potential tax deductions

Interest payments may be tax deductible, depending on the loan amount, even if you use your home equity loan for debt consolidation. The Internal Revenue Service has a full list of tax deductions for your reference.

Cons

- Higher foreclosure risk

While it helps reduce interest rates, using your home as collateral for your home equity loan for debt consolidation puts it at significant risk. If you can’t keep up with payments, you may risk foreclosure. - Home value may change

Borrowing against your home’s value relies on your home’s value not decreasing. If it does, you may owe more than your home is worth. - Closing costs and other fees

Fees for closing, administrative work, and other clerical services can add up. Closing fees usually cost around two to five percent of the loan’s total value.

How to Apply for a Home Equity Loan for Debt Consolidation

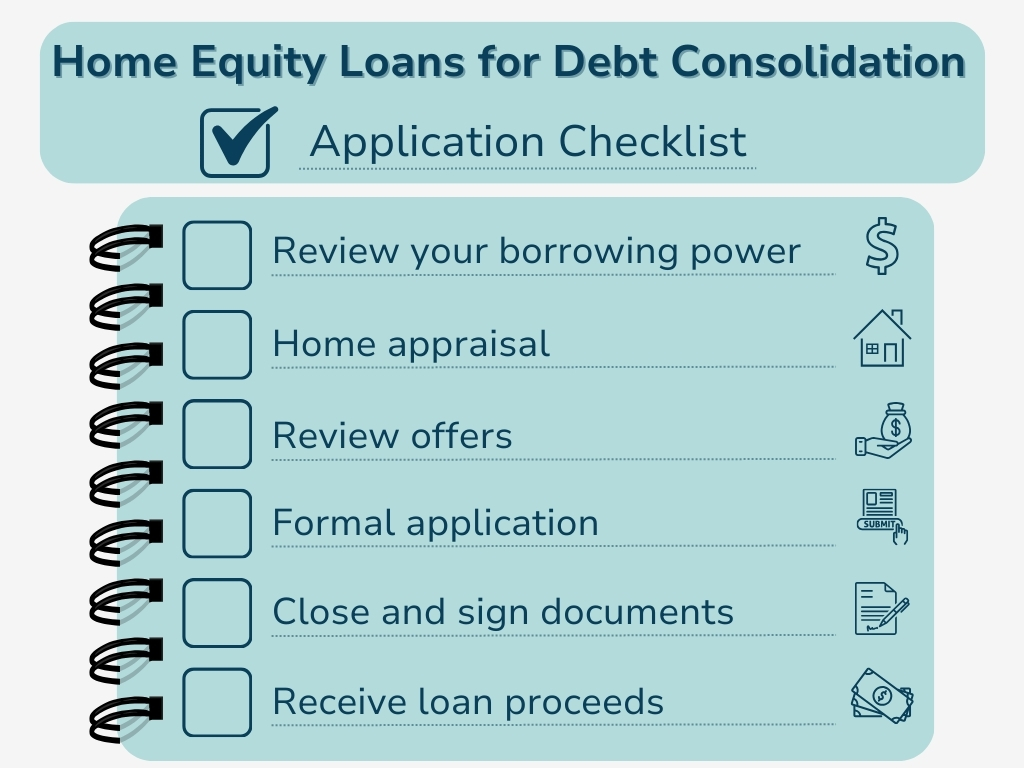

The process to apply for a home equity loan is quite similar to that of a primary mortgage. Here’s a brief overview of the process:

- Review your borrowing power

Assess how much of your home’s equity you can tap into and check your credit score. Remember that most lenders only let you borrow up to 80% of your equity in your home. - Home appraisal

The appraisal is a key part of the home equity loan process. You should know your home’s value before you borrow money against it. - Review offers

To get the best rates, it’s a good idea to shop around and check multiple different loan offers. - Apply formally

A formal application is one of the last steps in the home equity loan application process. Be prepared for processing and administrative work to take some time. - Close and sign documents

This is the last step, where it all becomes official. Be prepared to pay the closing costs, which can cost between two and five percent of the total value of the home equity loan for debt consolidation. - Receive loan proceeds

Armed with your home equity loan proceeds, you can now tackle your debt!

Determine how much of a loan you can take out on your current home with our free home equity calculator.

Alternatives to Home Equity Loans for Debt Consolidation

A home equity loan can be a great way to consolidate debts, but it’s not the only one. Some other popular methods of debt consolidation include:

- Home Equity Line of Credit (HELOC)

A HELOC, or home equity line of credit, is a loan type related to home equity loans with a longer, variable draw period. HELOCs operate similarly to credit cards by borrowing against your home’s value, so take care to avoid building up another substantial debt. They can be better for longer debt consolidation projects or smaller amounts. - Balance transfer credit cards

If your debt primarily comes from credit cards, a balance transfer credit card may offer a simpler solution. Many credit card providers offer accounts with extended periods with a 0% interest rate, designed for transferring existing credit card balances. These periods usually last 12 to 18 months. - Cash-out refinance

A cash-out refinance involves taking a new mortgage larger than your existing mortgage and using the excess cash to cover whatever you need. They can be helpful if you need a better interest rate on your existing primary mortgage or want to avoid the hassle of a second mortgage. - Personal loans

While rates for unsecured personal loans can be much higher than those of home equity loans, they may be lower than your existing debt interest rates. It’s much simpler to get a personal loan and won’t involve risking home foreclosure.

Final Thoughts

Tapping into your home’s value with a home equity loan for debt consolidation can be a great way to get your financial health in order. However, using your home as collateral can be quite risky, so make sure you’ve checked all your available options before proceeding with a home equity loan.

Remember that a home equity loan for debt consolidation isn’t eliminating your debt; you’re simply using the loan to transfer that debt to a single location. This makes it easier to keep up with payments and can simplify the process of tackling that debt.

We’re here to help you with this process. Contact Mortgage Marketplace, and we can help you determine if a home equity loan for debt consolidation is a good move for your financial future.

I appreciate the breakdown of closing costs—it’s something I hadn’t considered before. Great read!

Sammy P

Queens, NY

5/5

Great article! I didn’t realize how important it is to budget for maintenance and closing costs. Very helpful!

Jeremy M

Georgia, MD

5/5

This was super insightful! The tips on saving for a down payment cleared up a lot of confusion for me.

Tania N

Towns, CA

5/5

FAQ

How much home equity can you borrow?

+Most lenders will allow you to borrow up to 80% to 85% of your owned home equity.

Can you use home equity to consolidate debts?

+Debt consolidation is one of the best uses for home equity loans. If you’re stuck with a credit card bill or other personal debt with unfavorable rates, accessing home equity may be a prudent financial decision. A home equity loan is secured by using your home as collateral, giving you far better rates than unsecured loans like credit cards and personal loans.

What are the requirements for a home equity loan for debt consolidation?

+Requirements vary by lender, but you generally should own at least 20% of your home’s value and have a credit score of at least 620.

Who should use a home equity loan for debt consolidation?

+Debt consolidation is a great use for home equity, but make sure you can handle the loan’s payments. Your home is the loan’s collateral, which is what gives you such good rates, but it also puts it on the line if you can’t pay. Checking your available rates and comparing financing types is key – you may save more with a different loan or by using a balance transfer card.

Why Choose My Mortgage Marketplace?

Simplified Process

Effortless Application, Expert Support

From pre-approval to closing, our streamlined process and experienced team make home financing stress-free.

Tailored Solutions

Personalized Plans for Your Needs

Whether it's refinancing, home equity, or a new mortgage, we customize solutions to fit your financial goals.

Transparent Experience

Clear Rates, No Surprises

We provide competitive rates and full transparency, so you know exactly what to expect at every step.