Loans backed by the Federal Housing Administration (FHA) offer new homebuyers outstanding opportunities to purchase homes with favorable interest rates and simple, easy-to-meet credit and income requirements. These loans are typically intended for home buyers looking to buy a home to live in, but savvy real estate investors can also make effective use of them. However, with complex government requirements and oversight, how can investors use FHA loans for investment properties?

Using FHA loans for investment properties requires close attention to detail and a thorough understanding of FHA and lender requirements. However, real estate investors seeking assistance with FHA loans are in the right place – Mortgage Marketplace’s expert mortgage agents can answer your questions and help connect you to the lender that best fits your needs.

To learn more about FHA loans or how they could work for real estate investing, call us at (833) 970-1560 today.

Quick Summary

The Federal Housing Administration (FHA) offers a mortgage loan-backing program to assist low-credit and first-time homebuyers.

FHA loans can be used for investment properties, but FHA requirements are complicated and may be difficult for investors to meet.

Key requirements: Most FHA lenders require a credit score of at least 500.

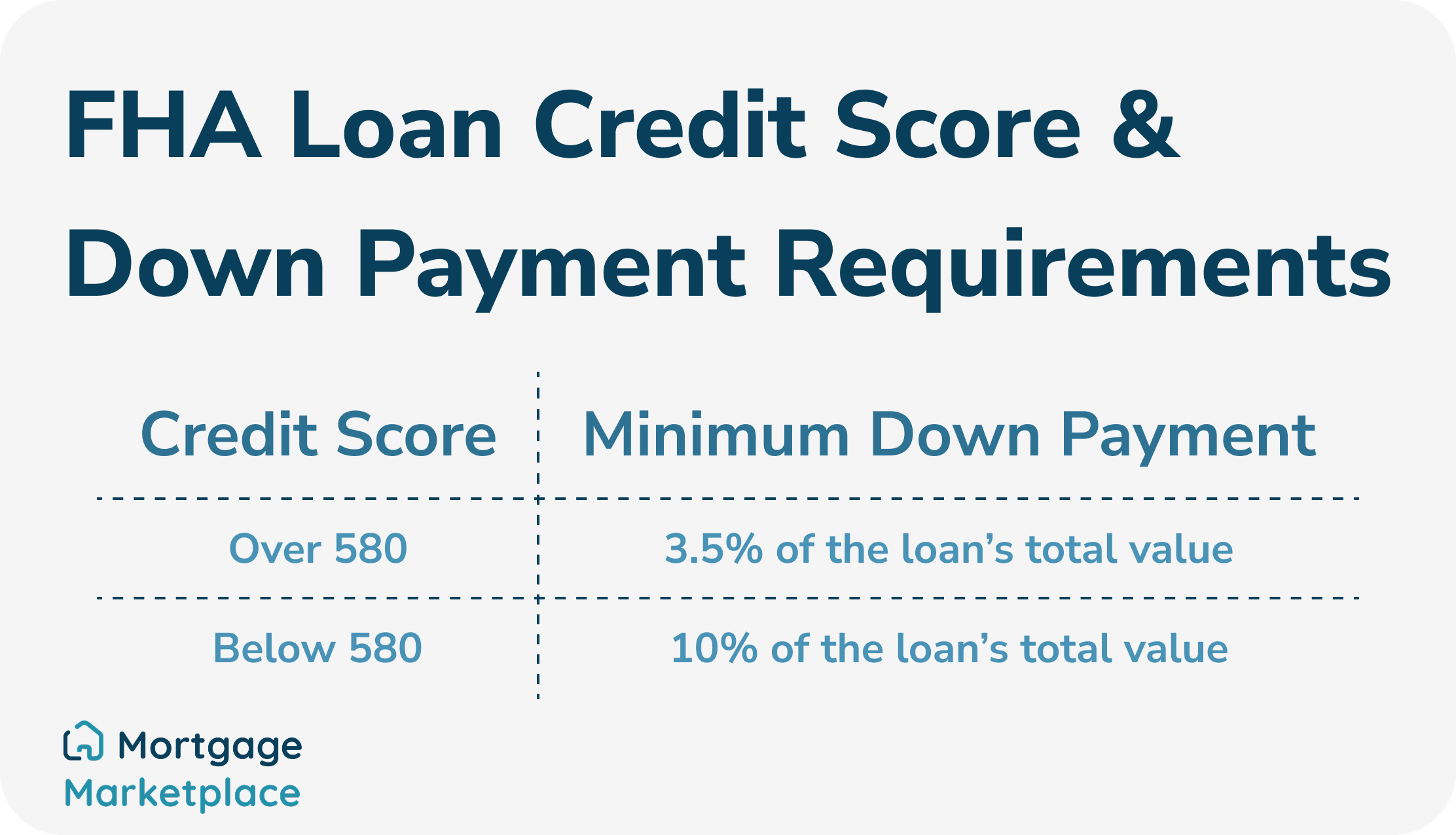

Tip: Credit and downpayment requirements are flexible. For example, borrowers with credit scores over 580 may only need to put down 3.5% of the loan’s total.

What are FHA Loans?

As part of an effort to assist first-time homebuyers, the U.S. Federal Housing Administration backs qualifying home loans, referred to as FHA loans. They’re ideal for borrowers with low credit scores or outstanding debt. Even if you have declared bankruptcy or have other documented financial issues on your record, you may still qualify for one. The FHA insures FHA loans, protecting lenders if borrowers are unable to pay back the loan, significantly lowering down payment costs and credit requirements.

Thanks to the FHA’s backing, FHA loan credit requirements are much lower than other home loans that are only backed by borrower income. Your credit score directly affects how much you can borrow with an FHA loan and how large a down payment you’ll need to pay. Here’s an overview of FHA loan credit requirements and how they affect down payments:

FHA loans work well for borrowers with limited liquidity or low credit, such as first-time home buyers with few sources of accessible equity. However, these loans come with a catch: the FHA has important home and borrower requirements that must be fulfilled for them to back borrowers.

FHA Loan Interest Rates

FHA loan interest rates are comparable to those of conventional mortgage loans, but with the added upside of simplified requirements and easier accessibility.

Why Do Homebuyers Use FHA Loans?

FHA loans are ideal for borrowers with credit scores too low for other types of loans. Borrowers who have declared bankruptcy may also qualify for an FHA loan. FHA loan lenders often accept lower down payments for borrowers with higher credit scores. These are just a few reasons why an FHA loan may be the best option for someone who may not qualify for other loan types.

FHA Loan Limits: How Much Can You Borrow with FHA Loans?

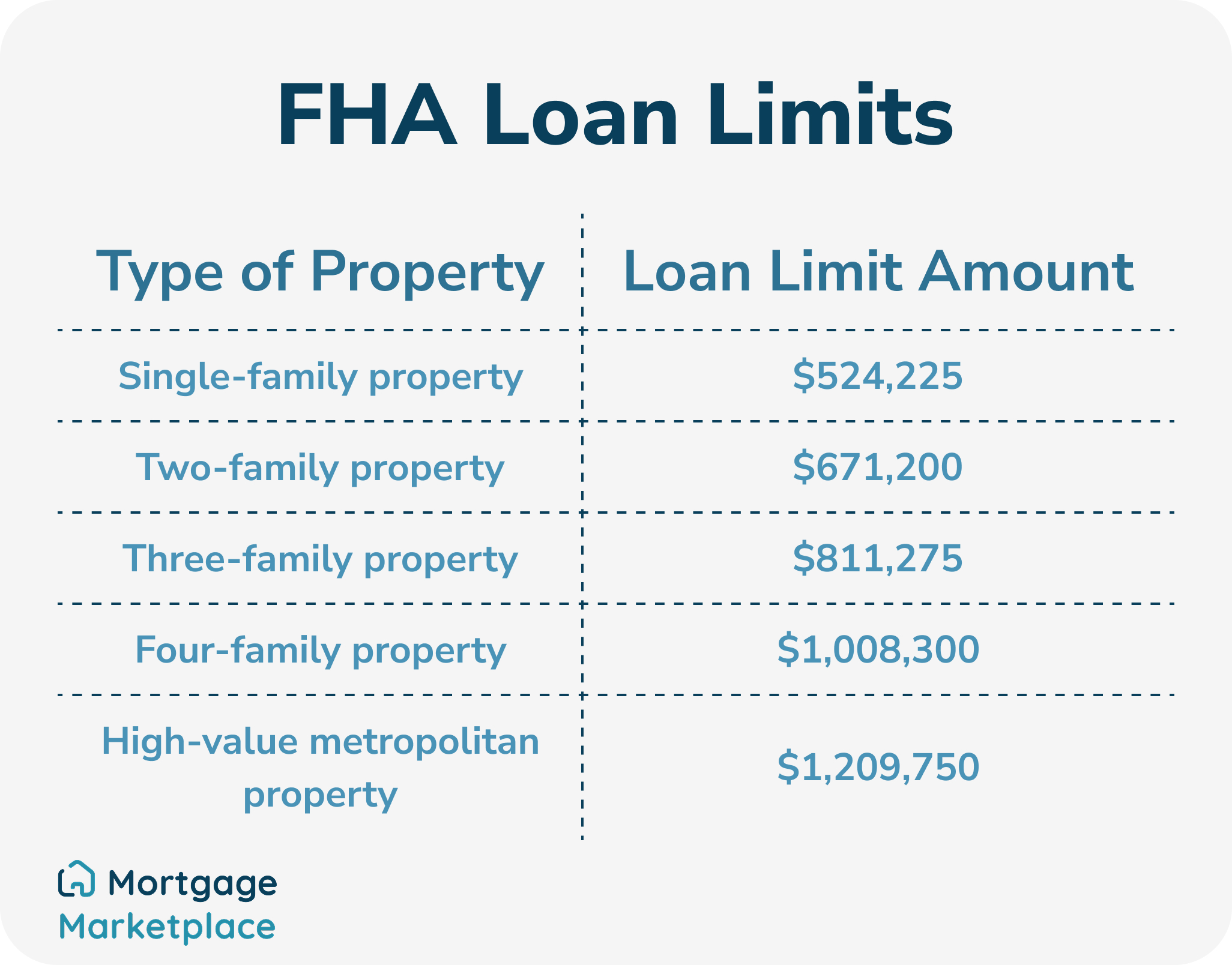

Borrowing limits for FHA loans are based on local median pricing and change yearly. They’re based on the property’s location; limits are higher for pricier urban areas and lower for more rural regions. Limits increase for multi-family properties, appealing for investors, but the FHA only allows for purchases of up to four-unit properties.

Here are the FHA’s 2025 loan limits by property type:

- $524,225 for standard, single-family properties

- $671,200 for two-family properties

- $811,275 for three-family properties

- $1,008,300 for four-family properties

- $1,209,750 for properties in qualifying metropolitan areas

To check your county or metropolitan area, check the FHA mortgage limit search tool.

FHA Loan Requirements

Borrowers and properties must meet specific criteria to be eligible for an FHA loan. Here are all of the FHA’s requirements and details about each:

FHA Loan Borrower Requirements

To qualify for an FHA loan, borrowers must meet not only FHA requirements, but also those of their selected lender. Because loans are backed by the FHA, borrowers with credit scores as low as 500 can qualify, but minimums vary by lender.

FHA loans normally require borrowers to have a debt-to-income (DTI) ratio no higher than 31%, but those with higher credit scores can qualify with higher DTI ratios. The FHA accepts borrowers with DTI ratios up to 43% if their credit scores are over 620.

The FHA doesn’t have specific income requirements, but FHA-approved lenders often do. Lenders will ask borrowers to provide proof of employment and income through several documents. Common documentation expectations include:

- Pay stubs

- W-2 forms

- Federal income tax returns

- Bank statements from at least the last month

Borrowers should be prepared to meet these expectations to qualify for an FHA loan. However, they’re much easier to meet than most conventional loan requirements.

FHA Loan Property Requirements

While requirements for borrowers are simple, the FHA’s property guidelines are stricter. FHA property requirements include:

- Property appraisal by an FHA-approved appraiser.

- Living on the property as your primary residence within 60 days of closing. You must reside on the property for at least one year.

- Obtaining an FHA loan requires that you have the property inspected, and it must meet minimum property standards.

FHA Loan Property Requirements

Properties purchased using FHA loans must meet the FHA’s minimum property standards. These standards are required to help borrowers purchase safe, move-in ready homes. The three requirements are:

- Safety

The home should be a safe, healthy environment, including protection against safety hazards like loose wiring, health risks like asbestos, and other major safety issues. - Soundness

The home should have sound and reliable structural integrity. - Security

The house is secure, with properly functioning locks on all doors, windows, and other openings.

FHA Loan Purchase Requirements & MIP

In addition to credit and down payment requirements, FHA loans also require a mortgage insurance premium (MIP). This insurance helps protect the FHA if the borrower fails to repay the loan, allowing them to provide more significant loan backing.

MIP requires an up-front payment equal to 1.75% of the loan’s total value. Annual costs vary by the property’s loan-to-value ratio, down payment value, term length, and the base loan amount.

Types of FHA Home Loans

Lenders offer several types of FHA-backed loans, designed to meet a variety of housing needs. FHA loan types include:

FHA Purchase Loans

FHA purchase loans are similar to standard, conventional mortgage loans. Down payments can be as low as 3.5% for borrowers with credit scores over 580, but requirements may vary by lender. Borrowers can use FHA loans to purchase up to properties with up to four units.

FHA Rate-and-Term Refinances

FHA loans aren’t just for purchasing properties; they can also be used for refinancing. If you want to take advantage of better interest rates but need the extra flexibility of an FHA loan, an FHA rate-and-term could be a good option.

FHA refinancing can be used to lower rates or change term lengths if your credit score has dipped since your initial home purchase, making them a great option for homeowners or investors looking to secure more favorable rates.

FHA Streamline Refinances

FHA streamline refinancing allows homeowners with existing FHA loans to do a rate-and-term refinance with a quicker application process and other benefits. Just like with a standard rate-and-term refinance, you can get a lower rate and more favorable term, but FHA streamline refinances have some additional special benefits.

You’ll likely be able to get a lower mortgage insurance rate because up-front MIP is just 0.01% of the loan’s total value, while yearly premiums are just 0.55%. FHA streamline refinances require less documentation than FHA purchase loans because borrowers have already proven they meet FHA requirements.

The FHA and lenders also require that at least 210 days pass between your first payment on your initial FHA loan and the first payment on the new streamline refinance. They also want you to prove that you can reliably make your payments, requiring:

- At least six payments on your existing loan

- No 30-day-late payments in the last 6 months

A maximum of one 30-day-late payment in the last year

FHA 203(k) Loans for Distressed Properties

FHA 203(k) loans can be used to buy a home and make renovations with a single loan, presenting a clear method for speculators to use an FHA loan for an investment property. The minimum loan balance for FHA 203(k) loans is $5,000, and any home repairs and improvements must be finished within 6 months.

Eligible improvements for FHA 203(k) loans include:

- Repairing health and safety issues that violate minimum property standards

- Foundation replacement and repair

- Structural repairs

- Flooring replacement

- Modernization improvements

- Accessibility improvements

- Roof repair and replacement

FHA Loans for Investment Properties

Most buyers use FHA loans to purchase single-family homes, but they can also be used to buy investment or rental properties. Newer real estate investors or those with low credit and limited liquid cash can make great use of FHA loans for investment properties, but they need to be used carefully to avoid legal and financial penalties.

However, smart investors can take advantage of FHA loans’ simpler credit and down payment requirements and creatively apply them to their investment needs. Here are some of the ways real estate investors can utilize FHA loans for investment property financing:

- Flip the home after meeting FHA requirements

The FHA requires that borrowers live in the purchased property for at least one year. An investor with a lower credit score can use an FHA loan to purchase a distressed property, fix it up and rehabilitate financially, then flip the property for a profit after living there for the required year.

- Purchase with an FHA loan, then refinance it

Investors with limited cash access or poor credit can purchase a property using an FHA loan and meet the FHA’s requirements while building credit and capital. They can then refinance using a more conventional loan type with more leeway for investing and either flip the property or use it as a rental property.

“House Hacking”

Investors can build some return on investment with properties purchased with FHA loans by utilizing “house hacking” techniques. These include buying a multi-family property and living at it while renting the other units, splitting the property with housemates, or designating a portion of the house for short-term rental use.

Risks & Downsides to Using FHA Loans for Investment Properties

Some real estate investors can have success using FHA loans for investment properties, but you should consider their weaknesses and risks before committing to this program. Some of the major risks and downsides to using FHA loans for investment properties include:

- Property limitations:

FHA loans are intended to be used for primary residences, severely limiting investment options. A savvy investor can navigate FHA property limits and can use the loan to purchase a multi-unit property, though it’s important to ensure you still meet the FHA’s requirements. - Increased costs:

Because FHA loans have such large up-front costs like closing costs and mortgage insurance premiums, it may take time to see a return on investment. Plus, with strict appraisals, you may need to shell out even more money for property repairs and upgrades to meet the FHA’s minimum property standards. - Strict refinancing rules:

Investors may want to use an FHA refinance loan for easy access to investment financing, but strict government and lender restrictions may make it tough to use your property for investing. - Legal implications:

FHA loan misuse could lead to loan fraud accusations, a serious legal offense that can result in major financial penalties. Borrowers who are caught misusing FHA loans may have to pay back the entire remaining loan balance, and if they can’t pay that balance back immediately, they may face foreclosure.

Carefully following the FHA’s guidelines will help you avoid these legal and financial implications. Though FHA loans can be used for investing, this isn’t the intended use, and it requires significant attention to detail.

Consult a Mortgage Marketplace professional today to review your loan options and determine if an FHA loan fits your investment needs.

Final Thoughts

The FHA’s loan support program is a great way to support first-time homebuyers and those with poor credit or financial issues. These loans can work for investors, but require careful use and detailed attention to the FHA’s intricate requirements.

For advice on how to properly use FHA loans for investment properties, contact Mortgage Marketplace at (833) 970-1560 today. Our expert mortgage agents can help you determine what loan options work best for your financial and investment needs.

I appreciate the breakdown of closing costs—it’s something I hadn’t considered before. Great read!

Sammy P

Queens, NY

5/5

Great article! I didn’t realize how important it is to budget for maintenance and closing costs. Very helpful!

Jeremy M

Georgia, MD

5/5

This was super insightful! The tips on saving for a down payment cleared up a lot of confusion for me.

Tania N

Towns, CA

5/5

FAQ

What is an FHA loan?

+The U.S. Federal Housing Administration (FHA) offers low-credit and first-time homebuyers loan backing opportunities called FHA loans. Though the FHA backs these loans, they aren’t lending them. This is provided by individual lenders and banks.

Can you use an FHA loan for an investment property?

+You can use FHA loans for investment properties, but investors must be careful to meet all of the FHA’s loan requirements.

Do you have to use a home purchased with an FHA loan as a primary residence?

+Borrowers must live in a property purchased with an FHA loan as a primary residence for at least one year.

What other loan options do investors have?

+FHA loans can work for real estate investing, but strict requirements with harsh penalties may dissuade investors. DSCR loans also work well for investors with limited liquid funds or credit setbacks.

Do lenders check if FHA loans are used for a primary residence?

+Both the lender and the FHA verify that FHA loans are used for a primary residence. They can have fairly simple ways to check this information, like utility bills, ID cards, tax returns, and employment information.

Can you refinance FHA loans to use properties for investments?

+Investors can refinance FHA loans to use properties purchased with them as investments. You can replace an FHA purchase loan with a refinanced FHA loan with better rates and terms, or a different mortgage type entirely.

Why Choose My Mortgage Marketplace?

Simplified Process

Effortless Application, Expert Support

From pre-approval to closing, our streamlined process and experienced team make home financing stress-free.

Tailored Solutions

Personalized Plans for Your Needs

Whether it's refinancing, home equity, or a new mortgage, we customize solutions to fit your financial goals.

Transparent Experience

Clear Rates, No Surprises

We provide competitive rates and full transparency, so you know exactly what to expect at every step.