Most people know what a mortgage is, but have you heard the term, second mortgage? The solution for accessing home equity without refinancing your initial loan exists through second mortgage options. With a second mortgage, you obtain home equity financing, which leaves your first mortgage unchanged.

Quick Summary

A second mortgage lets you borrow against your home’s equity without refinancing your original mortgage.

It’s often used for home improvements, debt consolidation, or major expenses.

Key Requirements: You must have sufficient home equity, typically at least 15–20%, to qualify for a second mortgage.

Tip: Compare multiple lenders to find the best rate and terms; small differences in interest rates can save you thousands over time.

What Is a Second Mortgage?

A second mortgage provides homeowners with a loan that uses their property as security while operating as a separate loan from their initial mortgage. The loan functions independently from your primary loan because it enables you to convert your accumulated home equity into available funds.

How It Differs from a First Mortgage

Your primary mortgage takes precedence over a second mortgage when you default since the latter is classified as a “second lien.” The foreclosure process works in a specific order because the original lender receives payment before the second lender. The availability of second mortgages appeals to homeowners who want substantial funds for projects like home renovations or debt unification or paying expenses for tuition and medical care.

How Do Second Mortgages Work?

The second mortgage process involves obtaining money from your home equity through the calculation of your home’s current market value versus your remaining primary mortgage balance. Your property serves as security for this loan while the terms of your existing mortgage remain unchanged.

Understanding Equity and Borrowing Power

Second mortgages come with either fixed or variable interest rates. A fixed-rate second mortgage offers predictable monthly payments, which can help with budgeting. Variable-rate loans might start lower but can increase over time depending on market conditions.

Interest Rates and Repayment with Second Mortgages

Repayment terms can vary depending on the lender, but second mortgages are typically paid back monthly over several years. Since your home secures the loan, missing payments could put you at risk of foreclosure, so it’s essential to understand the terms and borrow responsibly.

Do you know what your current monthly mortgage payments are? Find out now with our free mortgage calculator.

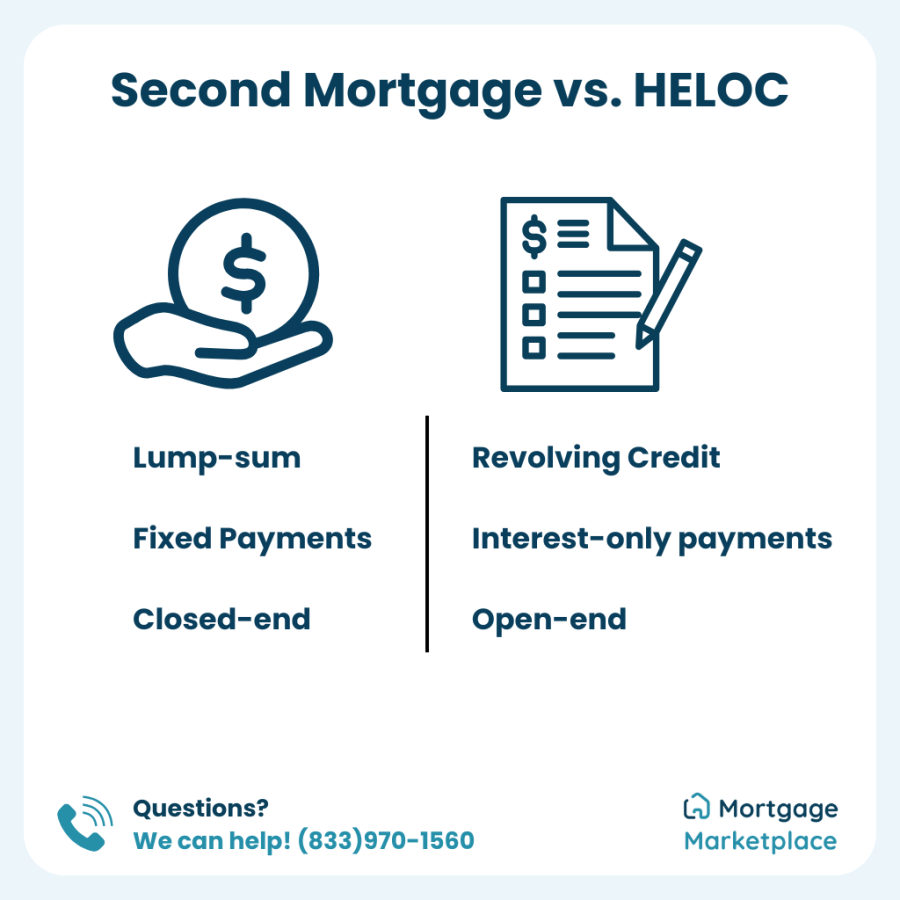

Comparing Second Mortgage Options: Home Equity Loan vs. HELOC

When people talk about second mortgages, there are two common types: the home equity loan and the home equity line of credit (HELOC).

While both allow you to borrow against your home’s equity, they work differently.

Home Equity Loan

A home equity loan gives you a lump sum of money up front, which you repay over time with fixed monthly payments and a fixed interest rate. This type of second mortgage is ideal if you know exactly how much money you need, like funding a major renovation, paying for college tuition, or consolidating high-interest debt.

Because of the fixed repayment terms, home equity loans appeal to borrowers who want predictability and stability in their budget. They also typically offer lower interest rates than unsecured loans or credit cards, making them a cost-effective option for large expenses.

HELOC

A home equity line of credit (HELOC) functions more like a credit card. You’re given a credit limit based on your home’s equity, and you can borrow from it repeatedly, during the draw period. One of the main advantages of a HELOC is its flexibility. During the draw phase, you typically make interest-only payments, which keep your monthly costs low.

Once the repayment phase begins, you’ll pay back both principal and interest. This structure is useful if your expenses are spread over time or you want a financial safety net.

Second mortgages, on the other hand, are usually closed-end loans with fixed payments. They may be better suited for homeowners who prefer a set budget and don’t want the temptation of open-ended credit.

Types of Second Mortgages

There are a few variations of second mortgages, each serving different borrower needs.

One common type is the closed-end second mortgage, a lump-sum loan repaid over a fixed term, often with a fixed interest rate. These are used by homeowners who need predictable payments and a set amount of money up front.

Another option is a hard money second mortgage, typically offered by private lenders. These loans are often used by investors or borrowers who don’t qualify for traditional loans due to credit issues or unique property situations. They come with higher interest rates and shorter terms, and they’re useful in some situations but carry more risk.

Is a HELOC a Second Mortgage?

Yes, a HELOC can be considered a second mortgage, but only when it’s taken out in addition to your first mortgage. What qualifies a loan as a “second mortgage” is its lien position, not its structure. If you take out a HELOC and still have a first mortgage, the HELOC is your second lien. While they are similar, it is important to note their differences.

That distinction matters because it impacts your repayment order in the event of foreclosure. But in everyday use, second mortgages and HELOCs can serve similar purposes, they just come with different structures and repayment expectations.

What Are Current Second Mortgage Rates?

Second mortgage rates vary depending on your credit score, income, loan-to-value ratio, and the type of second mortgage you choose. Generally, they’re higher than rates for first mortgages because lenders take on more risk. However, they’re often lower than personal, payday, or credit card loans.

To secure a competitive rate, it’s smart to shop around, improve your credit score, and consider working with a mortgage broker who can present multiple offers. Fixed-rate options offer peace of mind, while variable-rate loans may save you money in the short term if rates stay low.

Find your best second mortgage rate with My Mortgage Marketplace.

Is a Second Mortgage Right for You?

A second mortgage isn’t the right fit for everyone, but for many homeowners, it offers a powerful way to access cash without refinancing their first mortgage. You retain your loan terms and tap into equity you’ve already built.

If you’re facing high-interest debt, need to fund a big renovation, or want to invest in property without draining your savings, a second mortgage can help you reach those goals. Just be mindful that your home is the collateral. Defaulting on your payments can put you at risk of foreclosure.

Before moving forward, take the time to assess your financial stability, long-term plans, and ability to repay. Speaking with a qualified mortgage advisor can help you make the best decision for your situation.

Other Ways to Tap Into Equity or Invest in Property

If a second mortgage doesn’t meet your needs, consider other financing options, especially if you’re investing in property or managing a rental. One example is a DSCR loan (Debt Service Coverage Ratio), which is popular among Airbnb hosts and real estate investors. Unlike traditional loans, DSCR financing focuses on the income generated by the property rather than your W-2s or tax returns.

Whether you’re looking into Airbnb financing, a rental income loan, or even wondering how to qualify for a DSCR loan for an Airbnb, it’s worth exploring how these investment-friendly loans compare to traditional options.

Compare multiple loan options side by side to make informed decisions with our free loan comparison calculator.

Final Thoughts

A second mortgage gives you financial flexibility through space upgrades, debt management, and investment purposes without requiring a complete refinance of your primary loan.

At Mortgage Marketplace, we simplify the process so you can make confident, informed decisions. Get pre-qualified and take the next step toward using your home’s value to move forward financially. Apply online or give us a call today for expert guidance.

I appreciate the breakdown of closing costs—it’s something I hadn’t considered before. Great read!

Sammy P

Queens, NY

5/5

Great article! I didn’t realize how important it is to budget for maintenance and closing costs. Very helpful!

Jeremy M

Georgia, MD

5/5

This was super insightful! The tips on saving for a down payment cleared up a lot of confusion for me.

Tania N

Towns, CA

5/5

FAQ

What’s the difference between a second mortgage and a HELOC?

+A HELOC is a revolving credit line with flexible borrowing and interest-only payments during the draw period. A second mortgage is typically a one-time lump sum with fixed repayment.

Can I have more than one second mortgage?

+Yes, but it’s less common. Having more than one second lien can make it more difficult to borrow and may increase your overall risk.

What are the differences between a second mortgage and a reverse mortgage?

+While both let homeowners tap into their home’s equity, they serve different purposes. A second mortgage is a loan you repay monthly, often used for renovations, debt consolidation, or large expenses. A reverse mortgage, on the other hand, is designed for homeowners aged 62 and older. It allows them to receive payments from their equity instead of monthly payments.

What are the three types of reverse mortgages?

+There are three main types: HECMs (government-insured and most common), Proprietary reverse mortgages (private loans for high-value homes), and Single-purpose reverse mortgages (typically for specific needs like repairs or taxes).

Can a second mortgage be used for an investment property?

+Some lenders allow this, especially if you already own the property and are leveraging its equity. Be aware that terms may be stricter than for primary residences.

Is a hard money loan the same as a second mortgage?

+Sometimes. Hard money loans can be structured as second mortgages, but they’re typically short-term, high-interest loans from private investors and come with higher risk.

How do I qualify for a second mortgage?

+Most lenders look at your credit score, income, and the amount of equity in your home. A strong financial profile can help you qualify for better terms.

Why Choose My Mortgage Marketplace?

Simplified Process

Effortless Application, Expert Support

From pre-approval to closing, our streamlined process and experienced team make home financing stress-free.

Tailored Solutions

Personalized Plans for Your Needs

Whether it's refinancing, home equity, or a new mortgage, we customize solutions to fit your financial goals.

Transparent Experience

Clear Rates, No Surprises

We provide competitive rates and full transparency, so you know exactly what to expect at every step.