With our Mortgage Marketplace agent, we were able to find an affordable mortgage and finally purchase our dream home!

Unmatched mortgage services with personalized solutions, competitive rates, and expert guidance your homeownership goals made simple.

Homes purchased

10000

+

Customer satisfaction

98

%

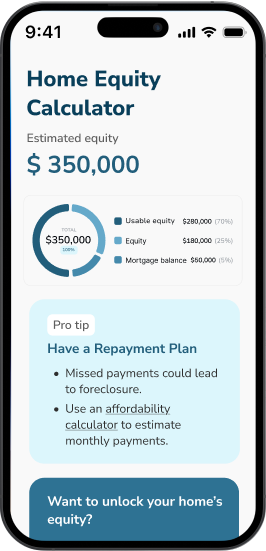

Home equity released

$

500

M+

Explore Your Best Mortgage Options Today

Make Your Dream Home a Reality

Flexible loans for first-time buyers, second homes, and investment properties.

APR low as

6.15%5/1 ARM, $250,000 loan

Lower Your Rate, Boost Your Savings

Cut down your monthly payments or shorten your loan term by refinancing your mortgage.

APR low as

5.79%30 year fixed, $200,000 loan

Explore Our Insightful Articles

Access expert insights, practical tips, and real-world guidance all in one place, just a click away.

Expert Insights

Clear, informative content from industry professionals.

Research-Driven

Every article is backed by real data and deep analysis.

Actionable Advice

Get practical tips you can use immediately.

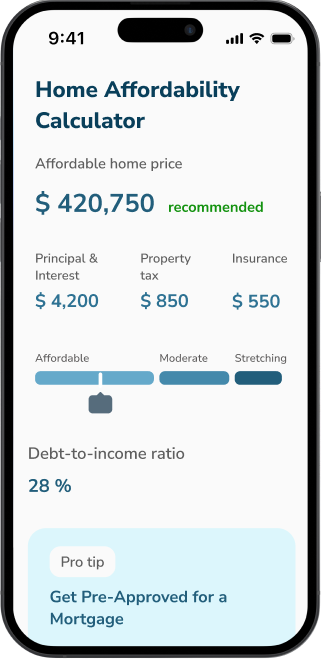

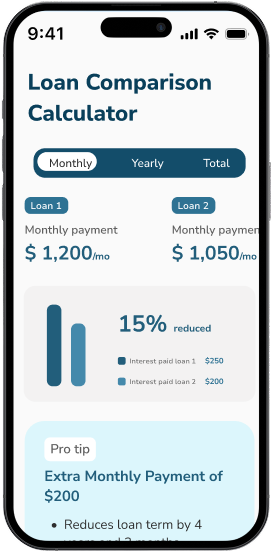

Mortgage Calculators

Figure out what you can afford, how much to borrow, or when to refinance — all in one place.

How We Help You

Simplified Process

Effortless Application, Expert Support

From pre-approval to closing, our streamlined process and experienced team make home financing stress-free.

Tailored Solutions

Personalized Plans for Your Needs

Whether it’s refinancing, home equity, or a new mortgage, we customize solutions to fit your financial goals.

Transparent Experience

Clear Rates, No Surprises

We provide competitive rates and full transparency, so you know exactly what to expect at every step.

Trusted by Over

10,000+ Homebuyers

10,000+ Homebuyers

Ready to set you journey?

Get StartedGet Started

Thanks to Mortgage Marketplace, we were able to tap into our home equity and start remodeling our kitchen AND bathroom. Long time coming!

Our Mortgage Marketplace advisor provided detailed market analysis and gave us the best deal on our DSCR loan. No wasted time or hassle.

Ready to Get Started?

Have Questions? Speak to Our Experts!

Get expert guidance tailored to your needs.